A GLOBALLY RECOGNISED CREDENTIAL

Why take the ctfp?

Develop a well-rounded trade finance skillset

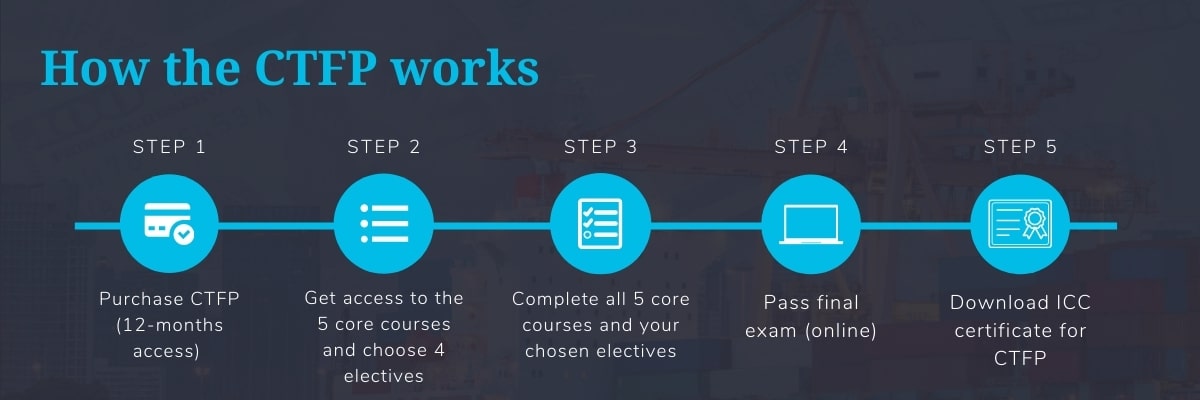

Unlike other trade finance certifications, the CTFP has a broad, comprehensive curriculum that will help you develop a wide range of expertise. Go beyond documentary credits to give yourself the freedom and flexibility to move between different roles and departments during your career (including front-office positions).

Core Courses

You must complete all 5 core courses.

Elective Courses

You must complete 4 elective courses of your choice.

Examination

Why take the ctfp?

Earn automatic credibility with clients

Earn automatic credibility with clients and colleagues with a credential from the ICC, the organisation that produces the rules and guidelines for the trade finance industry. The CTFP is an advanced, internationally accredited qualification that will help clients and colleagues see you on a different level. Trusted by alumni in more than 50 countries.

Houssam Hoteit

Senior Trade Finance Specialist

Royal Bank of Canada

"I see the CTFP as a perfect way for any trade finance person to have a certification that highlights your expertise and automatically puts you at a certain level that is respected in the industry.”

Ling Fong Tay

Head of Transaction Services, Product Management

SEB, Singapore

“I enrolled in the CTFP because this certification is authored by leading trade finance experts from the ICC’s Banking Commission, making it one of the most credible programmes available in the market.

THESE BANKS ALL USE THE CTFP TO TRAIN THEIR STAFF

Why take the ctfp?

Develop deep, practical expertise

The courses in the CTFP include case studies, assessment questions and downloadable study guides. All of these are designed to give you the deep, practical knowledge needed to feel comfortable and confident during discussions and negotiations with clients.

CTFP COURSE AUTHORS

The CTFP courses are authored by leading experts from the ICC Banking Commission.

Why take the ctfp?

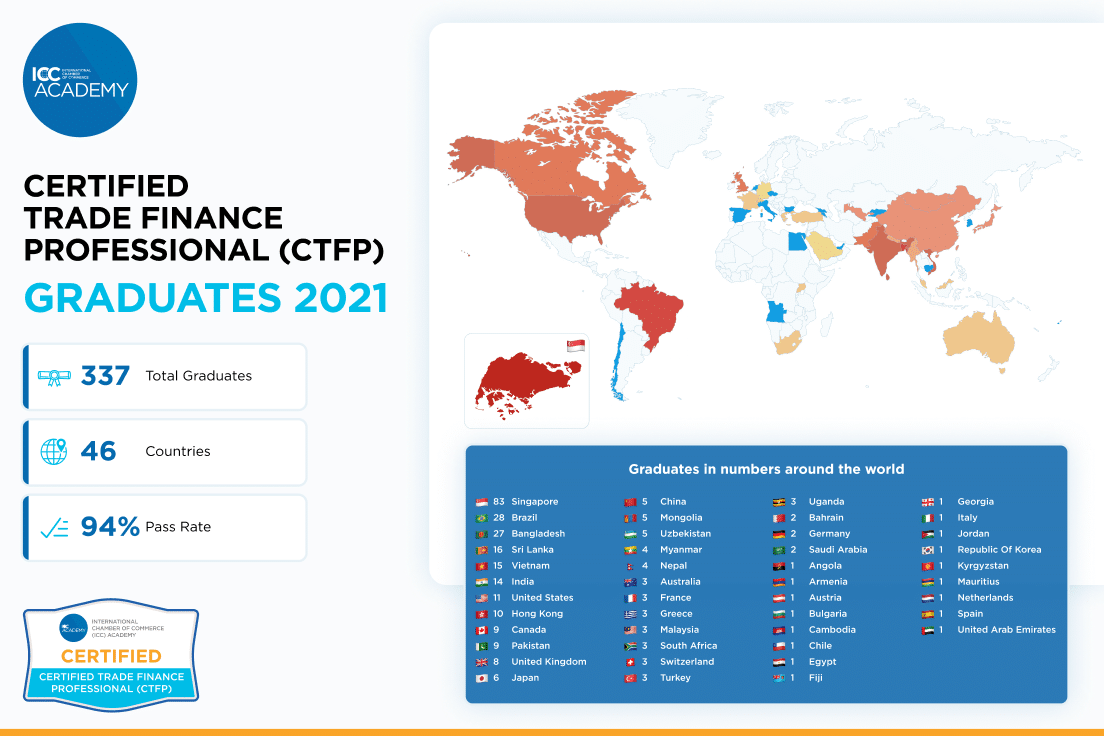

Global alumni network

Join CTFP alumni from more than 50 countries around the world, on every continent. Our alumni database will show you other CTFP graduates in your region who you can connect with via LinkedIn.

MEET THE LATEST CTFP GRADUATES

VIJAY KUMAR

Faisal Abdul Karim

Andi Veshi

Martin Kiwalabye

VIJAI KUMAR

Hui Lee Bong

Tamer Nasr

Roshan Lokubalasuriya

Thu Trang Mai

MIR SHAKEL AHASANI

Tatiana Kopylova

BAHADIR ÇATALBAŞ

Saleh Al Awad

Nchimunya Nicholas Nakalonga

Nomcebo Keke Mdlozini

Randy Willemsen

Cosmas Ojok

Spencer Haymes

Senthil Prasadh

Martin Kigozi

HITESH TALREJA

Neville Martin Raman

Jessica Mizambwa

Hana Alakeel

Umang Kataruka

Rafael Nobre

Abdulrahman Alotaibi

Mayank Mohan

Zogbeu Sopoude Alfred LOUA

Majed Abugaeid

Why take the ctfp?

Earn an ICC qualification without leaving home

The CTFP is 100% online, including the exam so you can fit learning in around a busy schedule. No classroom sessions to attend. No travel required. Study anytime, anywhere.

GET STARTED NOW

Choose from full enrolment, course 'stacking' or purchase for your team.

STACK CTFP COURSES

- Purchase 9 CTFP courses separately at US$200 each

- Stack up 5 core courses and 4 elective courses of your choice

- Pay US$100 to take the CTFP exam

- 50+ hours of total learning = US$38 per hour

- 12 months access to each course, ending on different dates

- **You may not have access to all courses when revising for the exam**

FULL CTFP ENROLMENT

- Purchase CTFP uprfront for $1499 - save $400!

- Get access to 5 core courses and 4 electives immediately

- Exam fee is included

- 50+ hours of total learning = US$30 per hour

- 12 months access to all courses, ending on the same date

- Access to all courses when revising for the exam

CTFP FOR TEAMS

- Dedicated service manager

- Customised integrated programme

- Personalised dashboard for tracking student progress

- Post-programme review

STUDENT FEEDBACK

Jahanzeb Khalid

Customer Service Manager, Trade Specialist

Mashreq Bank, UAE

“Passing the CTFP was a big factor in helping me secure a new job. It’s focus on the full range of trade finance techniques was very important and has given me a much more well-rounded understanding of the options we can offer our clients."

Nirupa Gupta

Deputy Director, Underwriting Credit & Surety

AXA, Singapore

“When people see your credentials, the CTFP from the ICC certainly helps. They recognise that you know your stuff and understand trade finance. The ICC brings with it its own brand which is very easily recognised.”

Muyiwa Esan

Global Trade, Access Bank, Nigeria

"The CTFP course has boosted my career prospects. Apart from earning a promotion late last year, I now possess the knowledge and expertise required to function effectively in all the key aspects of the trade finance business (operations, product development and sales)."

You may also be interested in

Advanced Guarantees

US$200

Learn important lessons on the issuance of a bank guarantee, the use of counter guarantees and more complex transactions.

Uniform Rules for Documentary Credits (UCP 600)

US$22

The latest edition of the ICC's rules on documentary credits.