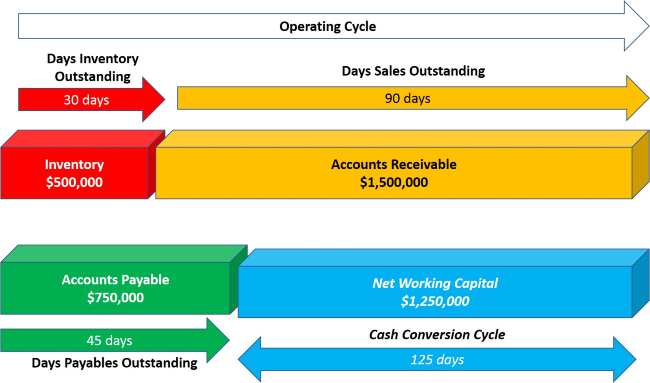

When an exporter’s operating cycle (length of time it takes to sell its inventory and collect on its sales) exceeds the credit terms extended by its trade creditors (suppliers), the exporter has a financing requirement. Export finance is needed to cover the gap between when an exporter is able to turn inventory and trade receivables to cash and when it has to pay on its trade payables.

For the purpose of this guide, export finance refers to the financing of working capital tied to exports, that exporters avail from banks, financial institutions and alternative finance providers (collectively “finance providers”).

The working capital components for trade are inventory (stocks), trade receivables (also known as accounts receivable and trade debtors) and trade payables (also known as accounts payable and trade creditors). The following formulae determine the exporter’s working capital financing requirements:

Inventory + Trade Receivables – Trade Payables

Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Working capital financing requirement can be expressed as a number in currency or in days.

The financing required is the net working capital amount and the cash conversion cycle (the difference between its payables days and operating cycle).

This guide covers short term working capital financing, i.e. financing related to items classified under current assets and current liabilities on the exporter’s balance sheet, and excludes from its scope long term financing techniques that may relate to capital goods or projects.

The methods of financing shown are representative, noting that variations exist. This guide is written from a finance provider’s perspective.

How is export finance differentiated within trade finance?

Trade finance is a broad term given to all the financing techniques tied to both imports and exports. However, the methods of financing are different, and they serve different purposes.

Examples of import finance include issuances of documentary credits and payment guarantees, and loans to pay for imports. Import finance techniques are typically provided with recourse to the importer, meaning it will be responsible to repay the finance provider for any funds advanced.

Export finance caters to the working capital financing requirements of exporters, and serves a combination of liquidity and risk mitigation needs. Depending on the nature of financing, some types of export finance may be provided on ‘non-recourse’ basis to the exporter. The favourable effect of non-recourse financing may be a reduction of the exporter’s net working capital and shortening of its cash conversion cycle.

It is important when providing any form of trade finance to understand the purpose of the financing, its appropriateness to the nature of the underlying trade, and the source of repayment or settlement.

Who are the main parties involved in providing export finance?

Export finance may be provided by banks, non-bank financial institutions such as factoring companies, and ‘alternative’ finance providers such as invoice finance marketplaces, trade finance funds and fintechs. Trade credit insurers also have a role, by providing protection to exporters and finance providers for trade receivables.

What are the different export finance products and solutions?

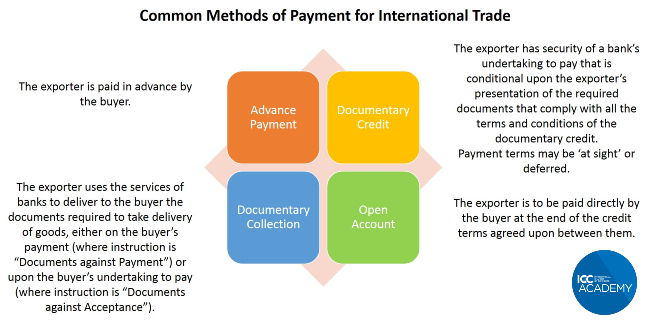

Export finance may be provided within the framework of either documentary trade finance or supply chain finance. The options for financing are linked to the method of payment that the exporter and the buyer have agreed to transact on.

Documentary Trade Finance

Documentary Credits

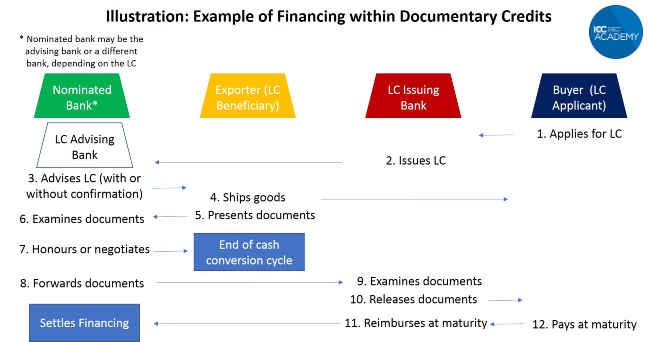

A documentary credit (also commonly known as letter of credit or LC in short) is a bank undertaking to pay its beneficiary (the exporter) based on a complying presentation of required documents to the issuing bank or a nominated bank (which may be a bank in the location of the exporter). The buyer makes an application to its bank to issue an LC to the exporter, based on terms that the buyer and exporter have agreed beforehand.

The ICC rules applicable to LCs are the Uniform Customs and Practice for Documentary Credits ICC Publication No. 600 (“UCP 600”), and they apply when the LC indicates that it is subject to the rules.

You can read more about how documentary credits work here and here.

When a nominated bank receives a complying presentation of documents from the exporter, it may prepay or advance funds on the drawn amount, acting on its nomination. Such financing can be on without-recourse basis, if the nominated bank is prepared to take the risk of the issuing bank. If the nominated bank is also a confirming bank, it would be obligated to provide such financing on a without-recourse basis.

There are many types of documentary credits and you can read our comprehensive guide to the different types here.

Documentary Collections

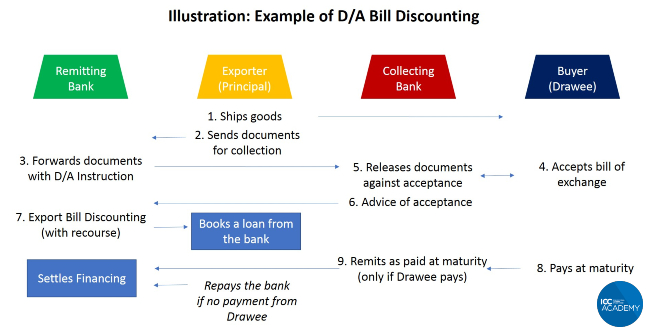

Documentary collections are used by exporters who wish to utilise banks as intermediaries for the release of documents to the buyer. A collection instruction is sent by the exporter’s bank (called a remitting bank) to a collecting bank in the location of the buyer and stipulates either Documents against Payment (D/P) or Documents against Acceptance (D/A).

A D/P instruction requires that the buyer pays for the amount drawn on them before documents may be released to them. A D/A instruction requires that the buyer incurs an undertaking to pay, such as accepting a bill of exchange drawn on them, before documents are released to them.

The ICC rules applicable to documentary collections are the Uniform Rules for Collection ICC Publication No. 522 (“URC 522”), and they apply when a Collection Instruction indicates that it is subject to the rules.

For D/A, the exporter is taking the payment risk of the buyer (drawee), as the collecting bank does not undertake to pay on the due date of the buyer’s payment undertaking. There is no provision in URC 522 for a bank to provide financing to the exporter. However, some banks may provide exporters with an advance against D/A acceptance (variously called Export Bill Discounting, Export Collections Discounting, Export Bill Financing, Export Bill Purchase etc.), which will be settled from proceeds of the D/A. Such financing is usually on with-recourse basis to the exporter.

The illustration below is an example of with-recourse financing of an export collection.

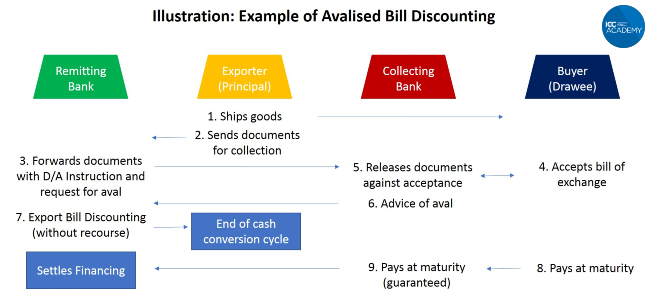

Although not provided for in URC 522, a documentary collection could also instruct that documents be released to the buyer against an ‘aval’ or guarantee by the collecting bank or buyer’s bank. Some banks may provide exporters with non-recourse financing based on the aval. The illustration below is an example of non-recourse financing linked to aval.

If the financing is provided on non-recourse basis to the exporter, the cash conversion cycle of the exporter will be shortened.

Advance Payment

Advance Payment Bond or Guarantee

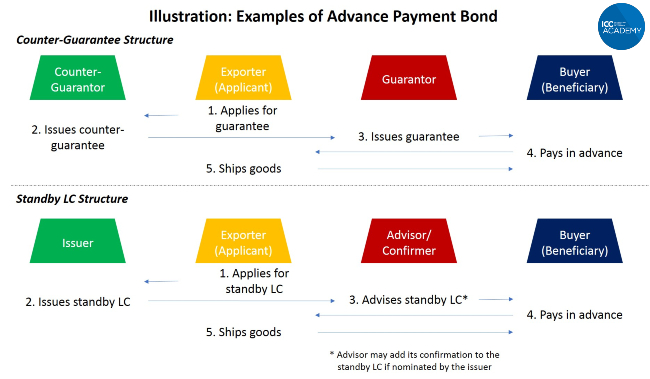

In advance payment, the buyer pays the exporter prior to shipment. The advance payment may be for a partial amount or the full amount of the purchase. The exporter would have no financing requirement for the advance payment but may be required in some cases by the buyer to provide an advance payment bond or guarantee.

An advance payment bond may be issued by the exporter’s bank, in the form of a demand guarantee or a standby letter of credit. It is an undertaking of the guarantor or issuer to pay on a complying demand or presentation by the beneficiary.

For some transactions, the buyer might require that the advance payment bond be payable by a bank in its own geographic jurisdiction. In such cases, the exporter’s bank may issue a counter-guarantee to a bank in the location of the buyer to issue the guarantee, or issue a standby letter of credit that may be confirmed by a bank in the buyer’s location.

The ICC rules applicable to demand guarantees are the Uniform Rules for Demand Guarantees ICC Publication No. 758 (“URDG 758”), and those that apply to standby letters of credit are the International Standby Practices ICC Publication No. 590 (“ISP98”) and the UCP 600. The choice of rules applies when the undertaking indicates that it is subject to the rules.

Further Learning: If export finance is an important part of your job, consider taking one of our internationally recognised courses and qualifications to bring your knowledge and skills up to ICC-endorsed, global standards. You can choose to focus specifically on export finance over a single course or earn a broader trade finance qualification like our Certified Trade Finance Professional (CTFP) that includes the course on export finance as part of a wider curriculum.

Supply Chain Finance

Supply chain finance (“SCF”) are a set of techniques and practices applied usually (but not exclusively) to the financing of open account trade. They can be classified under two categories:

- Loan or Advance-Based SCF

- Receivables Purchase

We’ll cover each of these categories in turn and the main techniques under each one.

Loan or Advance-Based SCF

These include:

- Loan or advance against receivables

- Distributor Finance

- Loan or advance against inventory

- Pre-shipment finance

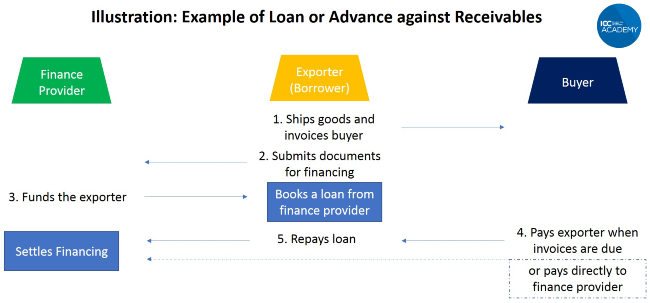

Loan or Advance against Receivables

Loans or advances against trade receivables may be variously called Receivables Lending, Receivables Finance, Invoice Financing, Invoice Discounting, Trade Receivable Loans, Trade Loans etc.

A finance provider makes an advance to the exporter (borrower), based on the existence of trade receivables evidenced by invoices to buyers, and transport documents. The tenor of the financing corresponds to the tenor of the receivables, and the financing is to be repaid from the export proceeds. The advance ratio may be 100%, or a lower percentage, of the invoiced amounts. Financing is usually on a with-recourse basis, i.e. the borrower is required to repay the loan or advance when due, even if payment for the receivables is delayed or not made by the buyer.

The loan may be secured by the trade receivables, by way of charge, assignment or pledge – the precise nature of the security arrangement will take into account various factors such as nature of receivables (e.g. if there are restrictions on assignment), jurisdiction(s) involved and commercial arrangement between the parties.

Or the loan could be unsecured, with the receivables serving simply as comfort to the finance provider that the borrower has a source of repayment.

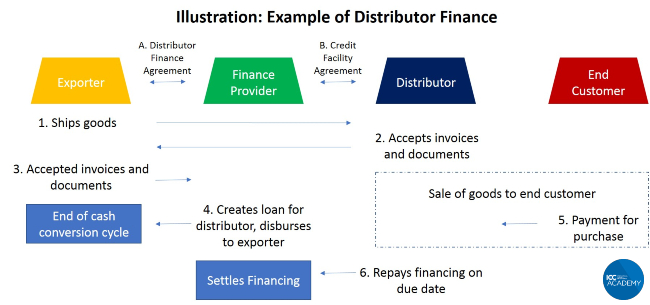

Distributor Finance

This type of financing may be variously called Distributor Finance, Buyer Finance, Dealer Finance, Channel Finance etc.

A finance provider may enter an arrangement with the exporter to provide financing to distributors of the exporter’s products in its foreign markets. A distributor may require financing for its cash conversion cycle, when its inventory and receivables days exceed its payables days to the exporter.

The finance provider grants a credit facility to the distributor to pay for its purchases from the exporter on the exporter’s invoice due dates and is repaid by the distributor from the proceeds of the distributor’s sales of the exporter’s products.

The finance provider takes risk on the distributor and may create a security interest in the distributor’s inventory and trade receivables. To further mitigate its risk, the finance provider may have certain arrangements with the exporter for stop-supply, buy-back and risk-sharing.

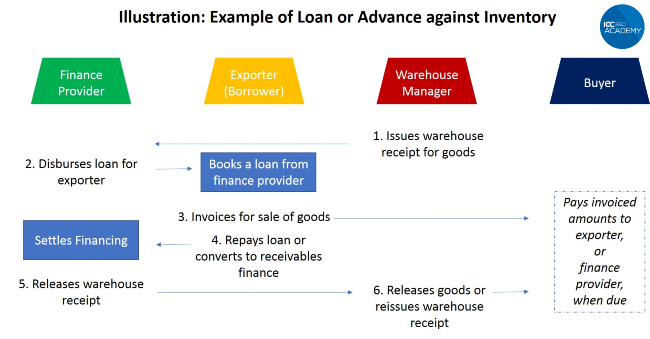

Loan or Advance against Inventory

Loans or advances against inventory may be variously called Inventory Finance, Warehouse Finance, Financing against warehouse Receipts etc.

Many variations in structure are possible for inventory finance. The finance provider finances an exporter for a percentage of the value of its inventory which may be pre-sold (for example, under an offtake agreement) or un-sold, taking the goods as collateral.

If the goods are stored in a warehouse, the finance provider may exercise control over the goods by way of contractual agreements with the warehouse operator and may appoint a collateral manager. The finance provider may disburse against delivery to it of warehouse receipts issued by the warehouse manager or collateral manager evidencing the finance provider’s rights to the goods referenced therein.

In order to effect delivery to the buyer, the exporter repays the finance provider which would then release the warehouse receipts for surrender to the issuers.

The illustration below is an example of inventory finance against warehouse receipts.

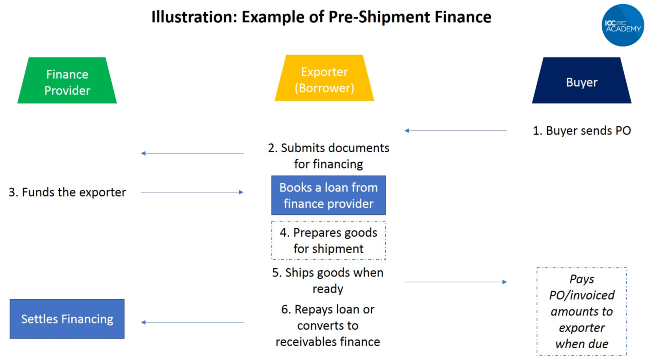

Pre-Shipment Finance

Pre-shipment finance is commonly also known as packing credit and purchase order (“PO”) financing. The basis of financing can be a PO, a sales contract or demand forecast.

An exporter may have cashflow requirements for purchase of raw materials, labour, factory costs and other pre-shipment expenses, prior to delivering on its export order. The finance provider may provide financing for a percentage of the exporter’s expenses and may disburse progressively according to the exporter’s stages of order fulfilment.

Settlement of the financing may be from payment by the buyer, or by way of converting the pre-shipment finance to a form of post-shipment financing (e.g. Receivables Discounting).

Receivables Purchase

Techniques for Receivables Purchase include:

- Receivables Discounting

- Forfaiting

- Factoring

- Payables Finance

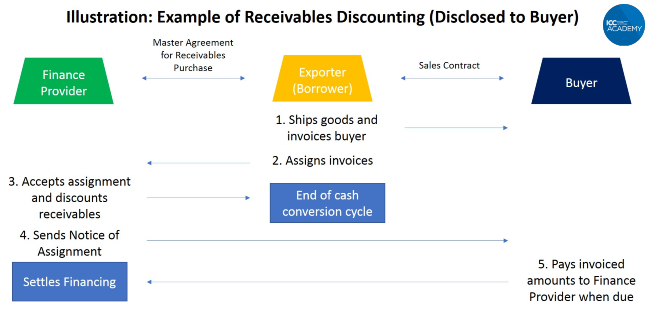

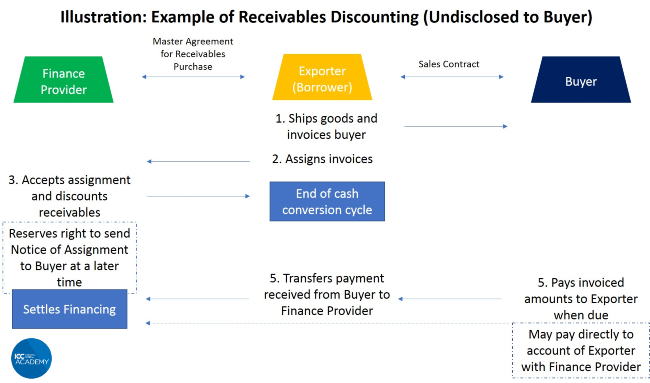

Receivables Discounting

Also called Receivables Purchase, Receivables Finance, Invoice Discounting etc., Receivables Discounting is a method of financing in which the exporter sells its trade receivables to the finance provider at a discount.

The trade receivables are commercial debt that is owed the exporter by its customers (buyers) and is normally evidenced by invoices issued by the exporter to the buyers. A finance provider acquires the right to be paid from such commercial debt, typically by way of assignment or transfer of the receivables by the exporter to it.

The primary source of repayment for the financing would be the buyer. The exporter may retain responsibility for the collection of the sold receivables on behalf of the finance provider.

Depending on agreement between the finance provider and exporter, financing can be provided on non-recourse basis, or with limited recourse, to the exporter. Trade receivables may be subject to dilution, i.e. reduction in the amount collected due to credit notes, goods return, warranty claims etc., which the finance provider may consider when setting the advance ratio for its financing.

The sale of receivables to the finance provider can be either disclosed or undisclosed to the buyer.

In a disclosed structure, notice of the exporter’s assignment or transfer of the receivables is served on the buyer, and the buyer may be instructed to pay directly to the finance provider.

In an undisclosed structure, notice of the exporter’s assignment or transfer of the receivables is not served upfront on the buyer, and the finance provider may reserve the right to serve the notice at a later time on the buyer, if needed, to be able to enforce its rights on the receivables.

Further Learning: If export finance is an important part of your job, consider taking one of our internationally recognised courses and qualifications to bring your knowledge and skills up to ICC-endorsed, global standards. You can choose to focus specifically on export finance over a single course or earn a broader trade finance qualification like our Certified Trade Finance Professional (CTFP) that includes the course on export finance as part of a wider curriculum.

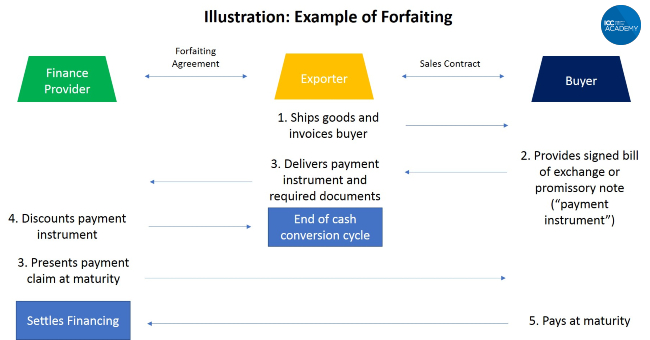

Forfaiting

Forfaiting is without-recourse purchase of future payment obligations represented by financial instruments distinct from the commercial transaction that gave rise to it. Typical financial instruments are bills of exchange and promissory notes, which are unconditional payment undertakings, capable of transfer by way of endorsement or assignment.

The buyer delivers to the exporter signed bills of exchange or promissory notes, according to their contract of sale, for goods or services delivered by the exporter. The finance provider may examine the documents for the underlying trade for which the payment obligations are incurred. The amount of financing is usually for 100% of the value of the payment obligation.

The ICC rules applicable to forfaiting are the Uniform Rules for Forfaiting ICC Publication 800 (“URF 800”), and they apply when the forfaiting agreement between finance provider and exporter indicates that it is subject to the rules.

In some cases, the payment obligation may carry an ‘aval’ by a third party such as a bank, in which case the financing may be provided taking the risk of the aval giver.

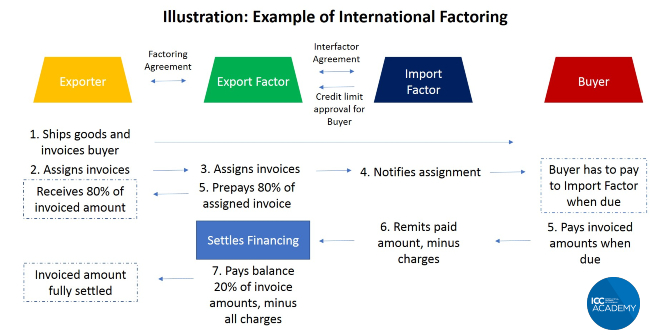

Factoring

Factoring involves the sale of the exporter’s trade receivables, represented by outstanding invoices, to a finance provider (a factor) who typically takes over the management of the debtors and collection of the payment.

Financing may be with recourse or without recourse to the exporter. When it is without recourse, the factor provides the exporter with credit cover for the risk of the buyer. A factor finances by advancing up to a percentage of the assigned invoice value, and upon collection of the full debt from the buyer, pays the exporter the balance amount after deducting for all its charges.

In international factoring, an export factor (finance provider to the exporter) may rely on an import factor (a factor in the location of the buyer) to provide credit cover for the risk of the buyer – this is known as “two-factor international factoring”. The export factor will finance the exporter taking the risk of the import factor, rather taking the risk of the buyer.

The invoices assigned by the exporter to the export factor are assigned by the export factor to the import factor. The import factor is responsible to collect payment from the buyer, and in case of protracted buyer default, will pay the value of assigned invoices to the export factor.

Members of Factors Chain International (“FCI”) may conduct two-factor international factoring based on FCI rules, which include the General Rules for International Factoring “”GRIF”), edifactoring.com rules (for use of FCI’s communications system) and Rules for Arbitration.

Many variations of factoring that differ from the illustrated example exist. The variations include recourse factoring, confidential or non-notified factoring and maturity factoring.

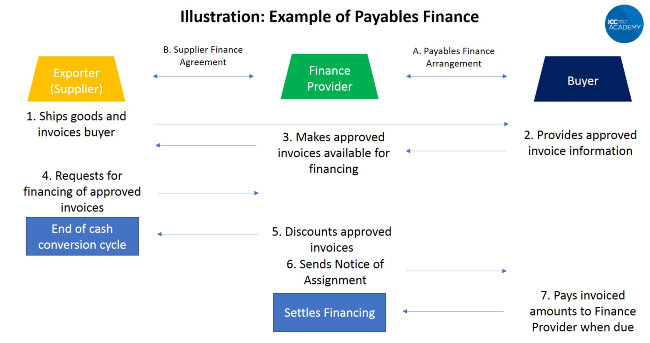

Payables Finance

Payables Finance is a method of financing for the exporter arranged by the buyer. It is variously called Reverse Factoring, Approved Payables Finance, Supplier Finance, Supply Chain Finance etc.

The exporter participates in a Payables Finance program arranged by the buyer with a finance provider. In such a program, the exporter and the buyer agree on (possibly longer) payment terms, which can be financed within the Payables Finance program. Exporter invoices are approved by the buyer as early as possible, and made available for financing with the finance provider based on the buyer’s undertaking to pay at maturity.

The exporter may request for financing of some or all the approved invoices, and typically assigns the invoices to the finance provider, which then makes an early payment, less interest and charges, to the exporter.

The finance provider is financing the exporter taking the risk of the buyer, based on the undertaking of the buyer to effect payment on its approved invoices and the exporter’s assignment of the buyer’s payables (exporter’s receivables). Such programs are often provided on a technology platform, when a high volume of invoices and transactions are involved.

What are the benefits of export finance?

Export finance as described in this guide provides the exporter with liquidity for its working capital requirements, and risk mitigation in some cases. The financing could either fund the exporter’s cash conversion cycle (in cases of with-recourse financing), or shorten the cash conversion cycle (in cases of without-recourse financing).

The availability of export finance benefits the buyer as well, as it enables the exporter to perform under their sales contract, enlarges the capacity of the exporter to sell more to the buyer, provides capacity for the exporter to provide credit terms to the buyer, and helps maintain supply chain stability.

Export finance in the context of COVID-19

The COVID-19 pandemic has resulted in some disruptions to physical supply chains, document delivery and credit appetite.

Disruptions to physical supply chains have resulted in longer operating cycles for some exporters, due to various factors such as longer inventory holding periods caused by slowdown of sales or shipment, or longer work-in-progress due to disruption in supply of certain raw materials or components.

Some disruption in document delivery occurred due to public health measures that restricted the movement of people, and suspension of courier services, resulting in the inability to make timely presentations for documentary credits and delays in the forwarding of paper documents between banks.

Reduction in credit appetite due to increased sensitivity toward various risks – insolvency, fraud, geo-political tensions – has had some limiting effect on trade finance availability. For example, some banks have scaled down financing for certain commodity trades and have even announced closures of some commodities financing desks.

The ICC has issued a guidance paper on the impact of COVID-19 on trade finance transactions subject to ICC rules, which addresses various issues including force majeure, document delivery and provisions of ICC rules.

All of the ICC’s rules for trade finance are e-compatible. The ICC has published a Digital Trade Roadmap that sets out recommendations to achieve digitalisation of trade. Problems that have been encountered during the COVID-19 pandemic due to reliance on physical movement of paper for trade and trade finance transactions underscore the need for digital transformation, and it is hoped that all actors in global trade (including governments and industry) will support and adopt the use of digital technologies for such transactions.

About the author

Tat Yeen Yap is a consultant trainer for ICC Academy. He has held positions as head of trade finance at banks including Société Générale and ABN AMRO. He has also been a contributor to ICC rules and the Global Supply Chain Finance Forum.

Contact details:

yty2020@outlook.sg

https://www.linkedin.com/in/tat-yeen-yap/

Further Learning

If you would like to enhance your understanding of trade finance further, we recommend taking our one of our internationally recognised, professional trade finance certificate programmes.

Global Trade Certificate (GTC):

The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and settlement methods available.

GTC Students get access to 14 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which you can use to improve your career prospects and work towards more advanced qualifications such as the CTFP.

Certified Trade Finance Professional (CTFP):

The CTFP is our advanced trade finance programme intended for those with five or more years’ experience working in trade finance or those with an existing trade finance qualification from the ICC Academy or LIBF. It is designed to give you the tools to confidently sell, deliver and process global trade finance solutions and is fast becoming an industry standard for senior trade finance positions.

CTFP Students get access to 11 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance, supply chain finance, fintechs, trade operations and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which will qualify you for more senior trade finance positions and help to fast-track your career.