Over the years, the ICC Banking Commission has become a leading global rule-making body for the banking industry, not only producing universally accepted rules and guidelines for international banking practice, but also providing leading edge research and analysis.

Today, the majority of modern documentary credits are issued subject to the International Chamber of Commerce (ICC) Uniform Customs and Practice for Documentary Credits, 2007 Revision, commonly known as UCP 600.

In this article we will explain some of the rules and guidelines contained within the UCP 600, as well as some related terminology, to give you a clearer understanding of how a documentary credit should be written. Think of this as a jargon-busting reference guide.

Parties Involved

It is essential to be aware of the parties involved in documentary credit transactions, a brief summary of which follows:[ref]UCP 600 Article 2 Definitions[/ref]

- Applicant: the party on whose request the credit is issued (the buyer).

- Issuing Bank: the bank that issues a credit at the request of an applicant or on its own behalf.

- Advising Bank: the bank that advises the credit at the request of the issuing bank.

- Confirming Bank: the bank that adds its confirmation to a credit, in addition to that of the issuing bank, to honour or negotiate a complying presentation.

- Nominated Bank: the bank with which the credit is available or any bank in the case it is available with any bank.

- Beneficiary: the party in whose favour the credit is issued and normally the provider of the goods, services or performance (the seller).

Addresses

UCP 600 sub-article 14 (j) states that when the addresses of the beneficiary and the applicant appear in any stipulated document, they need not be the same as those stated in the documentary credit or in any other stipulated document, but must be within the same country as the respective addresses mentioned in the documentary credit. It goes on to clarify that contact details in respect of the beneficiary’s and the applicant’s address can be disregarded. Such details would include email, telephonic and fax.

Amendments

A credit can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank, if any, and the beneficiary.[ref]UCP 600 Article 10[/ref]

Autonomy

A documentary credit has its own terms and conditions which do not rely upon the terms or performance of the sales contract. This is the principle of autonomy and relates to a documentary credit being treated as an independent transaction. The autonomy of a documentary credit has been re-confirmed in law many times over the years.

In effect, this leads to a documentary credit being considered as a primary means of payment (as opposed to a demand guarantee or standby letter of credit which is a secondary means of payment).

Clean Transport Document

It is common for documentary credits to state that the presented transport document should be ‘clean’. UCP 600, article 27 states that banks only accept clean transport documents and that such a document is one that does not expressly declare a defective condition of the goods or packaging. It was further clarified that the word ‘clean’ did not need to appear on the document.

Under ISBP 745, a transport document is not to include clauses that expressly declares a defective condition of the goods or their packaging.

Further Learning: If documentary credits are a tool you need to use regularly in your job, consider taking one of our internationally recognised trade finance courses and qualifications to bring your knowledge and skills up to ICC-endorsed, global standards. You can choose to focus specifically on documentary credits over a single course at an introductory or advanced level or earn a broader trade finance qualification like our Global Trade Certificate (introductory) or Certified Trade Finance Professional (CTFP) (advanced) that both include courses on documentary credits as part of a wider curriculum that also covers other trade finance techniques.

Complying Presentation

Complying presentation means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of UCP 600 and international standard banking practice. This is further expanded in UCP 600 Article 15.

As stated in ISBP 745[ref]Preliminary considerations (iv)[/ref], the applicant and beneficiary should carefully consider the documents required for presentation, by whom they are to be issued, their data content and the time frame in which they are to be presented. Only documents that are necessary (e.g. for customs clearance purposes) should be required by the credit. If feasible, it is recommended that documentary requirements be limited to an invoice and transport document.

eUCP

The eUCP became effective on 31 March 2002. A revised version of eUCP (Version 2) came into force on 1 July 2019. The principles on which the eUCP has been based are the underlying principles in the UCP and standard practice currently existing for eCommerce transactions. The eUCP focuses on the principles of electronic issuance and draws from practice in the paper world in functionally equivalent situations for electronic presentations.

Instalments

UCP 600 article 32 states that when an instalment is not drawn or shipped within the allowable period, then the credit ceases to be available for that and any subsequent instalment.

ISBP 745

The ICC Banking Commission first approved International Standard Banking Practice (ISBP) in 2002 as ISBP 645. Subsequently, ISBP 681 was released in 2007 to bring it in line with UCP 600. Approval for ISBP 745 was given on 17 April 2013.

- It is important to note that ISBP does not amend UCP 600. It explains how practices articulated in UCP 600 are to be applied by documentary credit practitioners.

- ISBP and the UCP should be read in their entirety and not in isolation.[ref]ISBP 745 Preliminary Considerations i.[/ref]

- The incorporation of ISBP into the terms of a documentary credit is deemed inappropriate, as the requirement to follow agreed practices is implicit in UCP 600.

- The publication reflects international standard banking practice for all parties to a documentary credit.

Letter of Credit vs. Documentary Credit

Both terms are in common usage and are synonymous. There is no distinction between the two but, as ICC rules commonly refer to ‘documentary credits’[ref]In particular UCP 600 and ISBP 745[/ref], this is the term used within this guide.

Negotiation

UCP 600 sub-article 6 (b) emphasises that a credit must state whether it is available by sight payment, deferred payment, acceptance or negotiation. All three terms can be found in UCP 600 Article 2 Definitions.

Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank. It is important to note that mere document examination does not constitute ‘negotiation’.

Pre-advice

Nowadays, very few credits are pre-advised. UCP 600 article 11, Teletransmitted and Pre-Advised Credits and Amendments, caters for the limited number of credits that comprise of a pre-advice with a subsequent mail or telecommunication confirmation.

Reasonable time

Former versions of UCP provided for banks to have a ‘reasonable time’ to examine documents. UCP 600 sub-article 14 (b) no longer refers to a reasonable time and limits the examination period to a maximum of five banking days following the day of presentation.

According to the ‘Commentary on UCP 600’ (ICC Publication No. 680) reference to reasonable time was removed due to the lack of a standard application of the concept globally. This does not, however, mean that the principle of reasonableness has entirely disappeared. Banks still need to be reasonable in the time taken to examine documents. For example, taking five banking days to examine a presentation consisting of a relatively few number of documents may not be considered as reasonable under the applicable law.

Strict compliance

The Executive Committee of the ICC Banking Commission released an ‘Issues Paper’ containing notes on the principle of strict compliance on 24 May 2016.[ref]https://iccwbo.org/publication/icc-banking-commission-executive-committee-issues-paper_notes-on-the-principle-of-strict-compliance/[/ref] As mentioned therein, the issue of ‘strict compliance’ had continually surfaced with respect to the examination of documents presented under documentary credits. Accordingly, the paper was released in order to represent the position of the Executive Committee.

It was highlighted that ISBP, particularly the latest version ISBP 745, has made a significant impact in lessening the exactitude of the doctrine of strict compliance. In fact, it is arguable whether or not strict compliance even exists any more. A review of the General Principles section of ISBP 745 highlights numerous aspects of the document examination process that reduce the need for a literal application.

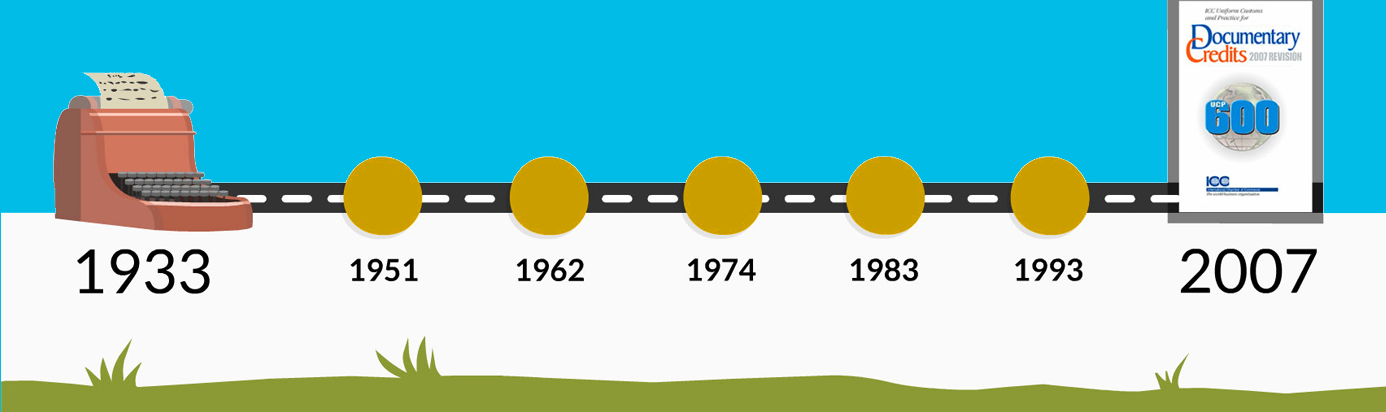

UCP 600

Documentary credits are governed by an international code of practice drawn up by the International Chamber of Commerce, known as Uniform Customs and Practice for Documentary Credits (UCP). These rules were originally introduced to alleviate the disparity between national and regional rules on documentary credit practice.

First published in 1933, and revised on five occasions since, the latest version is known as UCP 600. This comprises 39 Articles, which establish the requirements necessary to regulate documentary credit operations.

URR 725

Refers to the ICC Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits, Publication No. 725 (URR 725), which applies to any bank-to-bank reimbursement when the text of the reimbursement authorisation expressly indicates that it is subject to these rules.

The use of a reimbursing bank is often a determining factor when a nominated bank decides to honour or negotiate. Banks that are requested to add confirmation will often prefer a reimbursing bank to be nominated in the documentary credit rather than rely on settlement being made directly by an issuing bank upon the issuing bank’s receipt of complying documents.

PRACTICAL NOTICE

- This article is intended to be a practical complement to other training solutions and to provide guidance. You can find all ICC Academy’s online trade finance courses here.

- There are many important regulatory restrictions and requirements as well as business considerations that this article does not cover.

- Nothing contained herein is to be considered as the rendering of any legal or other professional advice for specific cases and readers are responsible for obtaining such advice from their own legal counsel or other professionals.

About the Author

David Meynell

Senior Technical Advisor, ICC Banking Commission

Co-owner www.tradefinance.training

Managing Director TradeLC Advisory

Tel: +44(0)7801 922359

Email: davidmeynell@aol.com

Further Learning

If you would like to enhance your understanding of documentary credits and trade finance further, we recommend taking our one of our internationally recognised, online trade finance certificate programmes.

Global Trade Certificate (GTC):

The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and settlement methods available.

GTC Students get access to 14 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which you can use to improve your career prospects and work towards more advanced qualifications such as the CTFP.

Certified Trade Finance Professional (CTFP):

The CTFP is our advanced trade finance programme intended for those with five or more years’ experience working in trade finance or those with an existing trade finance qualification from the ICC Academy or LIBF. It is designed to give you the tools to confidently sell, deliver and process global trade finance solutions and is fast becoming an industry standard for senior trade finance positions.

CTFP Students get access to 11 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance, supply chain finance, fintechs, trade operations and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which will qualify you for more senior trade finance positions and help to fast-track your career.