This is a guest post for ICC Academy by Pierre-Olivier Maes, who has held several functions in BNP Paribas Factoring. More information about Mr Maes can be found at the end of this article. The views expressed in this article do not necessarily represent the views of ICC or the ICC Academy.

What is factoring?

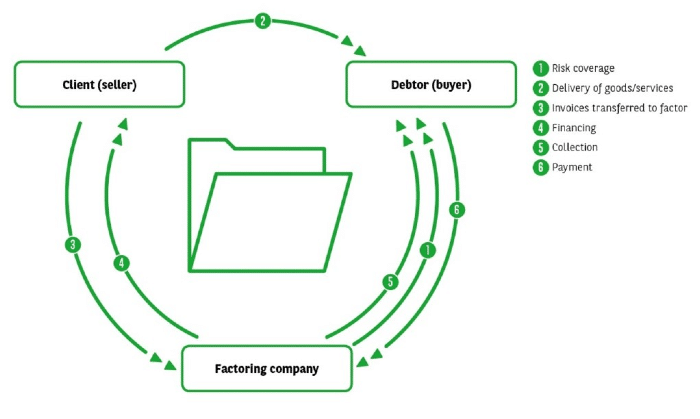

Factoring is a working capital solution. It a financial and risk mitigation service in which a company (the seller) assigns its accounts receivable (from buyers) (cf. below, 7.i) to a third party (the factoring company, called the factor) at a discount. The seller will also pay the factor a fee for providing this service.

Factoring consists of three major components:

- Financing

- The advancements on the (debtors’/buyers’) invoices are an ideal tool for financing working capital needs

- Risk coverage

- The risk mitigation element arises from the possibility to cover commercial buyers’ risks

- Receivables credit management (cf. below, 7.vi).

- A seller’s receivable accounts management may be outsourced to the factoring company, though the occurrence of that decreases due to informatisation and the fact that factoring companies entitle their clients to keep that component in-house (based on agreed covenants).

Factoring is also commonly called Accounts Receivable Financing, Commercial Finance or Invoice Discounting. It improves a company’s financial ratios and increases its debt capacity by selling its unsettled/outstanding sales invoices to a factor who will immediately settle the account, thus securing the company’s cash flow.

It assists clients in many ways, including their needs concerning:

- Working capital solutions

- Business growth

- Turnaround funding

- M&A funding

- Support of seasonal/cyclical activities

- Off-balance sheet treatment

- Debtor payment collection

- Debtor bad-debt protection

- Strengthening their negotiating position with suppliers

There two main sorts of factoring techniques;

Recourse factoring, where the factoring company does not take over the risk of bad debts/insolvency. In this case the receivable may be sold back to the seller. Recourse factoring implies the seller may still be at risk should his customer become insolvent or cease to trade. It is the seller who decides what credit terms he will grant buyers, based on his own credit research.

In non-recourse factoring, the factoring company takes over the risk of bad debts/insolvency, thereby accepting the financial credit risk of the seller’s buyers failing, and taking responsibility for accepted, individually agreed credit limits. The system of credit limits allows sellers to safely enlarge their sales volumes. This is even more important in unfamiliar markets and export situations.

Who are the key parties involved?

The factor

A factoring company is typically a subsidiary of a financial institution (bank or other). As a factor, it will help its clients (being sellers) with:

- Increasing debt capacity

- Improving Days Sales Outstanding (‘DSO’)

- Transferring fixed costs into variable costs

- Efficiency in sourcing new customers using up-to-date credit information and experience

- Protection against bad debts

- Flexible financing (level of financing remains in line with sales volumes)

- Improvement of financial ratios

- Possibility to gain increased discounts from sellers by paying them earlier

- Granting a self-liquidating credit facility

- Strengthening of commercial relations with the buyers

- Controlled cash flows, allowing better cash forecasting

- Allowing management to focus on core business activities

Unlike bank credit facilities, a factor will limit its financing risks by spreading its outstanding debts over a reasonable number of debtors. By limiting the concentration risk, it will make sure that in the event of an individual debtor failing, the loss damage impacts the security of either party less severely.

The seller

Typically, companies relying on factoring are providers of goods and services, quickly expanding companies, companies looking to improve their balance sheet structure, companies looking to rationalise their credit management and administration of accounts receivable, and companies looking to regulate their cash flows.

The debtor or buyer

The debtor or buyer is an involved party. However, depending on the disclosing of the factoring relationship and the local legislation, the buyer may be obliged to pay the factoring company. In most cases, that is what impacts the seller’s DSO positively.

How does factoring work?

Traditional factoring

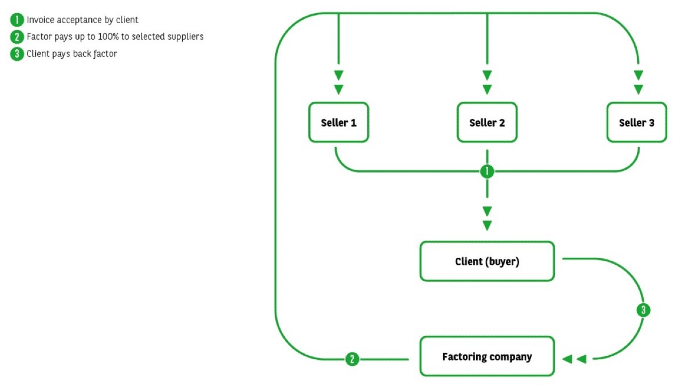

Reverse factoring

In reverse factoring the requesting party is a strong, positively rated buyer seeking to strengthen its relationship with certain suppliers.

You can find out more about supply chain finance in our introductory guide.

What criteria influence the 'factoring fee'?

The factor will calculate the factoring fee based on the type of contract (recourse or non-recourse), the number of invoices, and the question whether the debtor credit administration is insourced or not.

Benefits and limitations of factoring?

The factoring and commercial finance industry offers a wide range of products and services, which are extensively used by all kinds of companies.

The factor is an important working capital actor, generally granting short term flexible financing that follows the sales volumes of its clients (that way preventing unpleasant surprises when pay-back of the credit facility is due).

On top of that, the factor can provide an important mitigation of the commercial risk. When required by the client (seller) and accepted by its external auditors, the financing can be categorised as ‘off-balance sheet treatment’.

The factoring industry plays an important role in sustaining liquidity supply to businesses, particularly in periods of financial crisis. Factoring provides higher levels of finance to the user with fewer conditions than comparable traditional methods of funding.

In other words: factoring enhances the financial competitiveness of businesses, which is essential in allowing them to thrive and compete in domestic as well as international markets.

Because of its secured and monitored status, factoring is a very stable low loss given default financing solution, which makes it an important offering in the funding of the real economy in both growth and recessionary periods of the economic cycle.

Although the core of the service is the same and simple (a complementary source of finance based upon the assignment of receivables or other assets held by businesses), the products offered have developed in multiple ways, in line with the differences in local economic and productive structures, and the legal environments.

Factoring examples

Here are some examples showing the diversity and possibilities of tailor-made solutions that factors can offer:

Example 1.

When an important supplier of tubes took over a smaller competitor, its factoring partner proposed a recourse factoring in combination with an inventory facility (cf. below, 7.ix), with a facility limit amounting to EUR 18 million. An NBO (Non-Binding Offer) based on essential (if initially limited) information was issued at short notice, and swiftly turned into a BO (Binding Offer), which gave the company’s management the desired comfort.

As for the company, its management was very pleased with the way the factoring contract and the accompanying credit lines were finally implemented, and with the support the factor team offered. Its local management was not burdened with a mass of new responsibilities, while the new facilities would further empower it.

Example 2.

A supplier of digital TV products, with headquarters and R&D facility in Korea and a great number of offices in Europe and beyond, was contacted by a UK-based broker who introduced it as a potential client to a factor in Germany. A non-recourse undisclosed (cf. below, 7.iv) in-house factoring contract was put in place, with only one single debtor.

Example 3.

A European mainland metals processing company had the intention to acquire a UK company. It wanted to consider a refinance of the business, whose principal funding came through a factoring solution, and the factor introduced its UK entity to the Group CEO.

Eventually, the solution was a non-recourse factoring agreement, undisclosed (cf. below, 7.iv), with credit management (for all buyers/debtors) by the client (in-house factoring).

Key terminology

- Accounts receivable: Money owed to a company for goods and services, provided to the buyers on credit. The accounts receivable amount is an asset to the company.

- Asset based finance/lending: Any kind of lending secured by an easy to value asset (accounts receivable, inventory, plant & machinery, equipment and/or real estate). Has developed from more common in small and middle-market financing transactions, to being broadly accepted as a corporate financing tool.

- Dunning: The process of methodically communicating with debtors to ensure the collection of receivables.

- Disclosed / undisclosed: The buyer is / is not informed about the assignment in favour of the factor.

- Funding period: Maximum period of time receivables can be financed.

- Receivables management: All activities aimed at managing and collecting receivables.

- Risk coverage: Guarantee issued by the factor in favour of its client against debtor’s risk of insolvency, as well as the protracted default risk.

- Structured products: Articulated products offered by the Factor to its clients. These include, amongst others, reverse programmes, maturity factoring, and distribution finance.

- Inventory facility: Funding based on physical stock owned and held by the factoring client (supplier) or a third party. Granted when a client has significant cash tied up in inventory but cannot generate sufficient cash to trade from receivables finance. This kind of facility is provided in a number of jurisdictions (eg. UK, the Netherlands, Belgium).

About the author

Pierre-Olivier Maes, a Master in Economy at the Université Catholique de Louvain (Belgium), has been active in the banking sector for over 30 years. He has held several functions in BNP Paribas Factoring, and is currently developing the international factoring business programme in the coordinating team of the BNP Paribas Group.