Supply Chain Finance: An Introductory Guide

Supply chain finance (SCF) is a large and growing industry. In 2015, a McKinsey report suggested that SCF had a potential global revenue pool of $20 billion, while a 2017 ICC survey of banks in 98 different countries identified SCF as the most important area for development and strategic focus in the coming 12 months.

Clearly SCF is an important topic for anyone involved in trade and trade finance to be familiar with.

In this introductory guide you’ll learn:

- A simple explanation of what SCF is – you can see the official definition from the ICC here

- Why SCF has grown in popularity over the last decade

- The difference between traditional trade finance and SCF

- A summary of the benefits of SCF for each party involved

- Case studies from real businesses that use SCF

- Short, simple summaries of the main SCF solutions and techniques

- Graphics and diagrams to help you better grasp the concepts discussed

- Some recommended ICC Academy courses to take your learning further

Let’s get started.

What is supply chain finance?

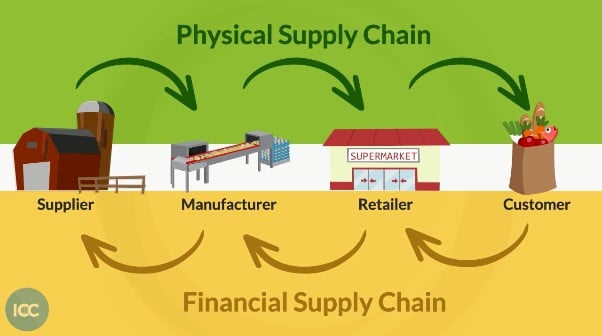

Any company’s commercial activities can be split into two categories: the physical supply chain, and the financial supply chain:

As you can see, the physical supply chain is the flow of goods and services towards the end-customer. Whereas the financial supply chain is the flow of money from the customer back up the chain to the supplier.

Supply chain finance (SCF) refers to the techniques and practices used by banks and other financial institutions to manage the capital invested into the supply chain and reduce risk for the parties involved.

Each financial intervention (financing, risk mitigation or payment) in the supply chain is driven by an event or ‘trigger’ in the physical supply chain. Some examples of these events are:

- Purchase orders

- Pre-shipment inspections

- Despatch/shipment

- Invoices raised by the seller

- Goods accepted by the buyer / entered the buyer’s warehouse

Here’s an example of what a SCF programme might look like:

Why has SCF grown in popularity?

International trade has long been financed through a series of instruments referred to as ‘traditional’ trade finance (such as documentary credits).

However, over the last few years, there has been a decided and sustained global shift away from these familiar mechanisms, based on the preferences of importers and exporters to conduct trade on ‘Open Account’ terms, whereby the goods are shipped and delivered before payment is due. In 2016, the total SWIFT trade finance volumes showed a decrease of 4.72%.

This shift has stemmed partly from emerging markets who believe that an insistence on documentary credit based trade reflects a lack of confidence in those markets and their institutions. The change has also been brought about by a move away from traditional bilateral trade arrangements (one buyer, one seller) to truly global supply chains which may now include relationships with communities of up to 10,000+ suppliers.

In this ecosystem of open account trade and a large, complex network of suppliers, the use of SCF has blossomed.

Open account trade

Supply chain finance is typically applied to open account trade where the goods are shipped and delivered before payment is due. The goods, together with all the necessary documents, are shipped directly to the importer who has agreed to pay the invoice on a specified date.

This option is obviously the most advantageous for the importer (buyer) in terms of cash flow and cost. The exporter (seller) accepts potential cost, significant risk, and the possibility of non-payment for a variety of reasons – some of which might not even be in the exporter’s control.

So why would exporters choose to use open account trade?

Because open account trade can help to bring customers into competitive markets and exporters can use one or more appropriate trade finance techniques to mitigate the risk of potential non-payment.

How is SCF different to trade finance?

A common question about supply chain finance is how it differs to more traditional trade finance.

While both trade finance and supply chain finance are designed to finance international and domestic supply chains, trade finance offers a broader set of solutions.

Traditional trade finance

Trade finance products are long-established and include letters of credit, bank guarantees and documentary collections, which are all used more frequently when trading partners do not know each other well, or at all.

Supply chain finance

Supply chain finance refers to more recently developed financing and risk mitigation techniques and is far more likely to be used in relation to open account trade where the buyer and seller have done business together before.

Benefits of SCF to each party involved

Seller (Exporter)

- An exporter could be (and often is) a small and medium-sized enterprise, frequently based in a developing or emerging market, supplying to a large buyer, based perhaps in the Americas or Europe. In such a scenario, SCF provides a small supplier with a range of options for accessing affordable financing, perhaps reducing the time taken to collect payment and thus significantly improving the company’s cashflow which can be used on something else

- Removes outstanding debts (Receivables) a company is owed from their balance sheets

- Allows another party to assume the payment risk on their behalf

Buyer (Importer)

- SCF allows a buyer to utilise their often higher credit rating to obtain better payment terms

- SCF enables an importer to assure the financial health of their suppliers and service providers that sustain a given supply chain which helps ensure ongoing operations, timely production and continuing sales activity

- SCF enables importers to get banks and finance providers to assume the risk on their behalf

Banks

- SCF means banks and other finance providers can purchase assets at a discount which they can then sell on to investors and/or make a profit on when they collect the full amount of the receivables

SCF Techniques

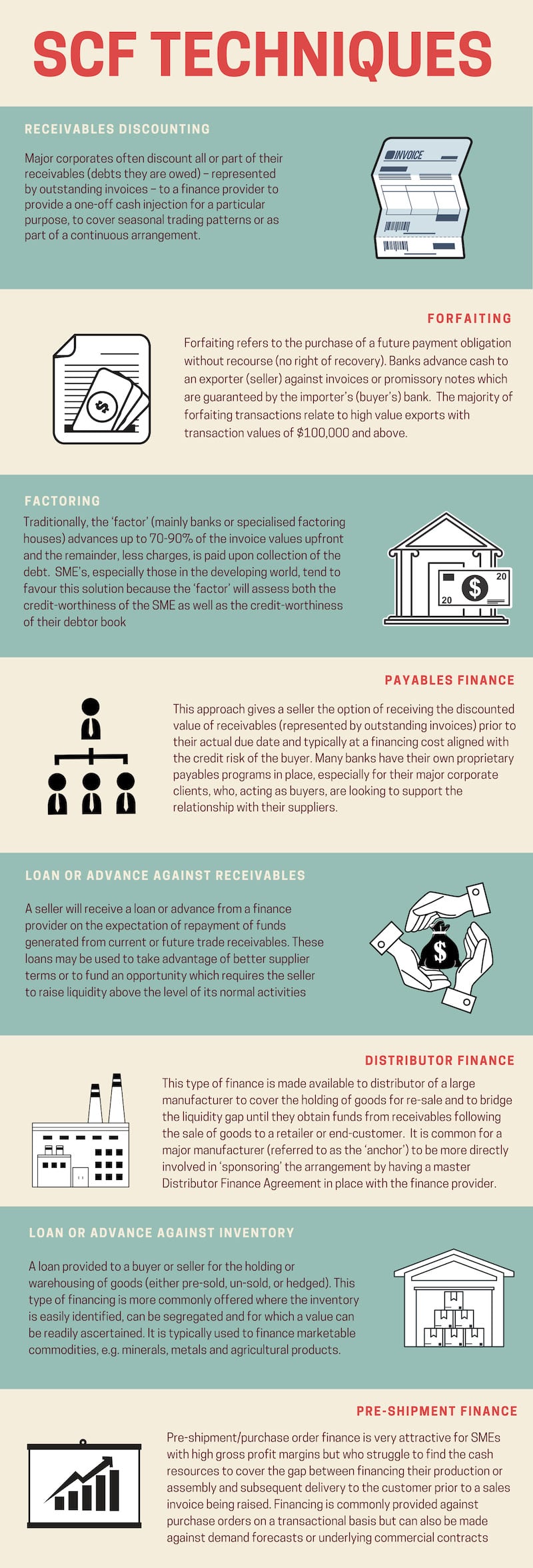

Supply chain finance provides a number of potential solutions to those involved in international trade, all of which have historically developed to service different markets and client segments:

SCF case study: Incomlend

Incomlend offers supply-chain financing as a solution for suppliers and buyers to bridge the cash flow gap that is preventing many businesses from scaling up.

One of their clients, a leading multi-national Indian company in the mobile handset industry, manufactures self-branded phones which are sold in India, Thailand, Nepal, Bangladesh, Sri Lanka, Indonesia, Mexico, Pakistan, Russia, and the Middle East. Parts required to manufacture the products are sourced from a large number of small suppliers from across Asia.

These suppliers deliver goods to their client on a monthly basis while only receiving payment 120 days after invoice issuing. This arrangement creates a cash gap of 4 months between invoice execution and payment. As a result, this cash flow gap makes it more difficult for the supplier to pay for recurring costs (staff, rental, overheads) as well as prepare the next production and delivery of goods.

Incomlend helped the client provide its suppliers with cash right after shipment of goods, instead of waiting 120 days. This is done by purchasing suppliers’ receivables at a discount.

According to the feedback from their client, Incomlend’s supply chain financing solution has had a double positive impact. First, benefit for the suppliers who strengthened their financial situation, reduced delays in deliveries and improved the overall quality of the goods delivered. Instead of having to struggle with tight cash flow, the solution allowed the suppliers to focus on increasing productivity, innovation, and efficiency in their production. Second, it benefitted the client who improved relationships with its suppliers and increased supply stability and quality by allowing the suppliers to get cash in advance.

Careers in SCF

Banks around the world are placing a bigger and bigger emphasis on supply chain finance and their employees will need to have an in-depth knowledge of SCF if they want to feel confident talking to clients and colleagues and subsequently proposing solutions. If you want to build on what we have covered in this guide then our internationally recognised courses and certificate programmes could be for you.

Here are a few recommendations:

This is a full certification programme that will give you a broad understanding of international trade, not just SCF. Students take six core courses and can choose three elective options (from a list of eight), one of which is an Introduction to Supply Chain Finance. Once you have completed the required nine courses you will receive an ICC Academy certificate, which you can use to improve your job prospects in the SCF industry and enhance your resume.

Introduction to Supply Chain Finance

If you would prefer to focus solely on SCF, then our introductory level individual course is the best option. The course provides a practical overview and will help you engage effectively and credibly with clients, recognize opportunities to propose SCF techniques as potential solutions to the needs of importers or exporters, and correctly describe the nature of SCF relative to traditional trade financing options such as documentary letters of credit.