This is a guest post from Baldev Bhinder, Managing Director of Blackstone & Gold LLC, the first energy and commodities law firm in Singapore dedicated solely to the full life-cycle of commodities in trade. Please note this is an opinion piece and Baldev’s views do not necessarily represent the views of ICC or ICC Academy. For any clarification regarding the rules we recommend you take the official Incoterms® 2020 Certificate or purchase the Incoterms® 2020 Publication from the ICC.

The new version of the Incoterms® rules, the Incoterms® 2020 came into effect earlier this year. There have been slight tweaks to the rules (please see commentary from the ICC Academy here on the new changes).

While the new Incoterms® rules seek to bring themselves more in alignment with the practicalities of international trade, they also present an opportunity to revisit some of the old misuses of the Incoterms® rules and some common mistakes. No three letter acronyms have been more misunderstood, mangled or misapplied.

We set out 5 basic issues that are vital in the correct application of the Incoterms® rules.

1. What are the Incoterms® rules not used for?

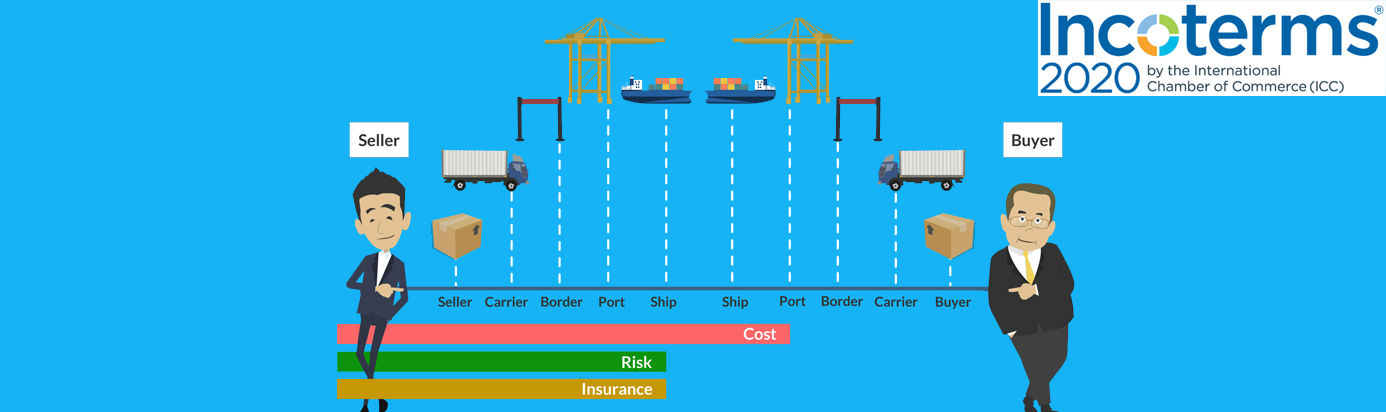

Incoterms are a set of 11 terms devised to identify, amongst other things, the point of delivery from seller to buyer in the international supply of goods. With the point of delivery comes the passing of risk from one party to another. However, these humble three letter acronyms cannot be used for:

They are not a substitute for a sales contract dealing with payment and quality terms.

The Incoterms® rules do not represent a contract of carriage for the goods.

Specifying an Incoterms® rules does not tell you which law to apply or how to resolve a dispute – all of that must be decided expressly by contract.

Most commonly misunderstood is that Incoterms do not deal with the passing of title in the goods. Title of the goods is a separate concept to risk and the passing of title is dictated by contract, typically upon payment of goods. Parties must pay close attention to when risk and title passes as the trigger for each milestone may not be in alignment.

2. The FOB vs CFR distinction

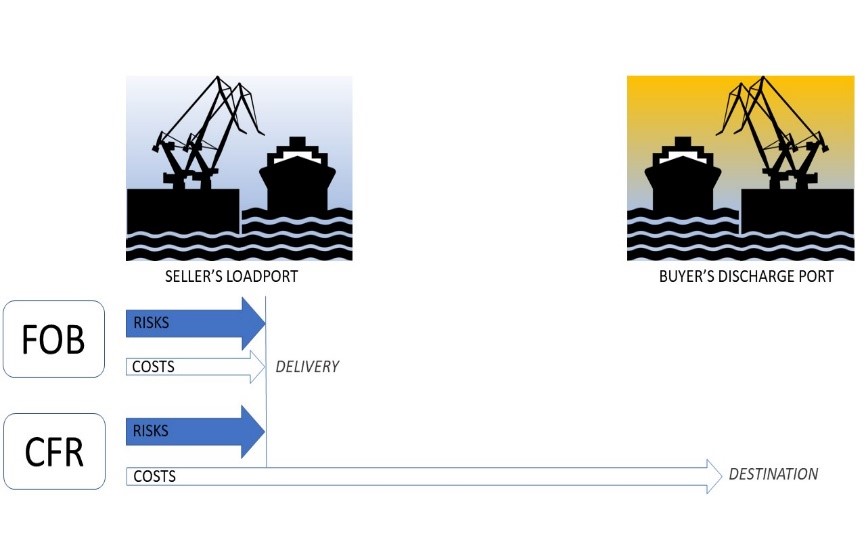

Even the most seasoned commodity traders may tell you that Incoterms® rules are essentially FOB versus CFR/CIF on opposite ends on the spectrum. The fallacy lies in a misconception that CFR/CIF denotes the seller’s responsibility to bring the goods to the destination. This is in incorrect – the passing of risks in FOB or CFR/CIF is largely the same.

The difference between the two commonly used terms lies in the responsibility for costs and freight (see the blue colour coding below).

- Fire at the warehouse at the port of loading;

- Damage/ contamination while the goods are at the berth awaiting loading;

- Goods falling off a crane while loading onto the vessels; or

- Damage/contamination while the goods are at sea.

Delineating the transfer of risk can help parties manage such perils, in particular by obtaining suitable insurance coverage.

3. FOB for containerized cargo?

FOB delineates the passing of risk when the goods are loaded onto the ship, but has poor correlation to how containerized cargo is moved.

In modern day shipping, sellers on FOB terms would have their cargo placed in containers. These containers may be stacked at port long before the containers are loaded onto the vessel. This produces an incongruency because the loading of the container is completely out of the seller’s control and yet with FOB terms, the seller holds on to the risk until that container is loaded.

In that respect, FOB’s lesser known cousin, FCA (Free Carrier) is far more appropriate as risks can be effectively passed earlier on when the good are delivered to the export terminal or other specified location.

4. Be precise

The Incoterms® rules deal with delivery and hence specific locations are essential.

CFR Shanghai may not be specific enough to direct which port freight should be arranged to. If parties wish to be assured of the delivery of goods at the destination port, then the “D terms” (DAP, DPU and DDP), typically used in the oil and gas sector may be more appropriate.

In such cases , particularly when transportation can be arranged by land or sea, the exact location of delivery is key. DAP Shanghai, Airport Terminal 2, highlights the kind of specificity recommended to avoid complications over where delivery has occurred.

5. Mixing Incoterms® rules with shipping terminology

Mixing shipping terminology with Incoterms® rules can produce some bewildering and unintended results.

Shipment dates are typically used in sales contracts to identify the period by which shipment must occur and is a vital provision because a breach of the shipment period may give rise to termination rights. It is not uncommon for shipment dates to be combined with an Incoterms® rule, but here is where misconceptions can get amplified with dangerous consequences.

As mentioned before, CIF gets conflated with an obligation to ensure delivery and hence a shipment period of June CIF may be viewed as an obligation to ensure delivery by June to the destination port. This is incorrect, as the trigger for the obligation for CIF is at the load port and not the destination port, which means a buyer’s right of termination should be premised on the load port instead.

Contracts can get more confusing when additional concepts are mashed into a clause, for example, “CIF, Shanghai loading laycan June 20-25”. Here laycan, a charterparty term used to specify when a vessel needs to be presented at the loading port, has been confused with a delivery period and does not sit neatly with the concept of CIF where the seller makes the carriage arrangement.

Mixing shipping terms with Incoterms® rules can produce some unintended effects.

The Incoterms® 2020 present an opportunity to not just learn about the new changes, but also to rectify some historically erroneous views on its application.

If you have any comments on this article, please feel free to reach out to Baldev.

Ready to learn more?

The best place to start is our Incoterms® 2020 Certificate, the only online course on the new rules that is fully endorsed by the ICC. Our course was written and reviewed by members of the ICC Incoterms® 2020 Drafting Group – make sure you learn from an authentic, legitimate source.