This comprehensive introduction to forfaiting will help you get a better understanding of this method of receivables purchase.

The guide covers what forfaiting is, its key features and how it works in practice. We have included diagrams and examples of transactions with and without forfaiting, so you can easily see the impact it has on an international trade transaction.

Thank you to Zeyno D. Davutoglu, Executive Vice President / Division Director, Bank Relations and Supply Chain Finance at Credit Europe Bank N.V. who wrote this guide for ICC Academy. You can find more details about Zeyno at the end of this post.

What is forfaiting?

Forfaiting is a method of trade finance whereby the forfaiter purchases, on a without recourse basis, debt obligations arising from the supply of goods and/or services.

The Standard Definition for Techniques of Supply Chain Finance defines forfaiting as “a form of Receivables Purchase. It is without recourse purchase of future payment obligations, represented by negotiable or transferable financial instruments; at a discount or at face value in return for a financing charge.”

In a forfaiting transaction, the exporter agrees to assign its rights to claim for payment of goods or services delivered to an importer under a contract of sale, in return for a cash payment from a bank or finance provider.

In exchange for the payment, the forfaiter takes over the exporter's debt instruments and assumes the full risk of payment by the importer. The exporter is thereby freed from any financial risk in the transaction and is liable only for the quality and reliability of the goods and/or services provided.

A brief history

The word forfaiting derived from the French word “forfeit” that means to transfer the right on the receivables. For example, the exporter forfeits its receivable rights to the forfaiter.

Forfaiting was originally developed in 1950s in Switzerland. The initial aim was to assist exporters of capital goods. Whereas importers of the capital goods wanted to defer payment until after the capital goods became active and so paid for themselves, the exporter did not want to sell on an open account basis.

What are the key features and what organisations act as forfaiters?

Forfaiting is a flexible discounting technique that can be tailored to the needs of a wide range of counterparties and domestic and international transactions.

Its key characteristics are:

- 100% financing without recourse to the seller of the debt

- The payment obligation is often but not always supported by a form of bank guarantee

- The debt is usually evidenced by a legally enforceable and transferable payment obligation such as a bill of exchange, promissory note, letter of credit or note purchase agreement.

- Transaction values can range from US$100,000 to US$200 million

- Debt instruments are typically denominated in one of the world’s major currencies, with Euro and US Dollars being most common.

- Finance can be arranged on a fixed or floating interest rate basis.

- Discounted receivables can have maturities as short as 6 months or as long as 10 years.

- Fast conclusion of transactions

- Tailor-made financing solutions

- Simple documentation requirement

- Relieves the exporter from administration and collection problems.

A forfaiter can be a specialized finance firm or a department in a commercial bank that performs non-recourse export financing through the purchase of medium and long-term trade receivables.

Recently we have been witnessing more players coming to the market. This includes asset managers, pension funds investing in the product and specialised fintechs who are showing increasing appetite for this asset class.

How does forfaiting work?

Here are a two step-by-step examples of how forfaiting works.

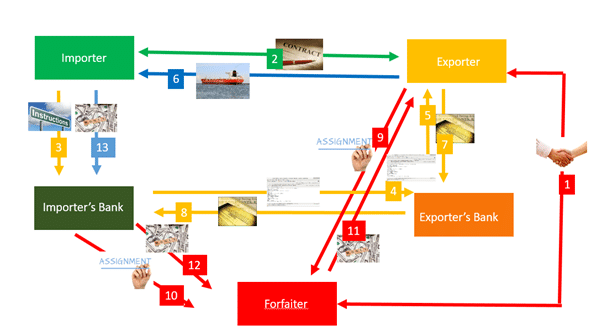

Example 1: Discounted Letters of Credit

- Forfaiting terms are agreed between the exporter and the forfaiter

- Importer and exporter agrees on the commercial contract for the underlying trade

- Importer gives instruction to its bank to issue a letter of credit (L/C)

- L/C is issued to the exporter’s bank to be advised and/or confirmed to the importer’s bank

- L/C is advised to the exporter by the exporter’s bank

- The goods are shipped by the exporter.

- Exporter presents shipping documents to its bank for acceptance.

- Exporter’s bank sends documents to importer’s bank

- Exporter assigns its rights to the forfaiter

- Importer’s bank accepts the assignment

- The forfaiter discounts the L/C and pays the exporter

- At maturity the importer’s bank pays to the forfaiter

- Importer pays to its bank

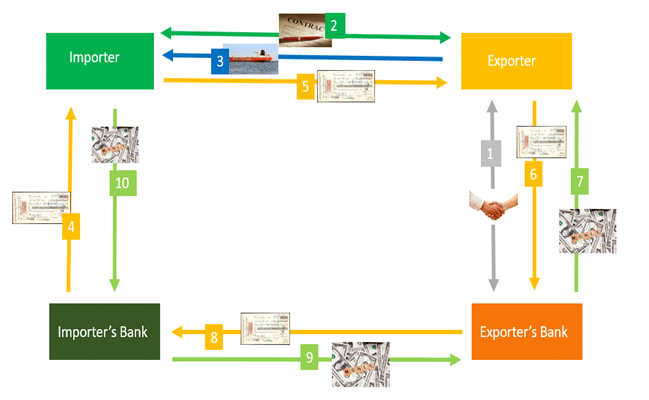

Example 2: Discounted Receivables

- Forfaiting terms are agreed between the exporter and the exporter’s bank that it is the forfaiter in this case

- Commercial contract for the underlying trade is made.

- The goods are delivered by the exporter.

- Presentation of debt instruments to the guarantor bank for avalisation. Transactions are evidenced by negotiable debt instruments such as promissory notes or bills of exchange.

- Delivery of avalised debt instruments to the exporter for acceptance.

- Delivery of fully endorsed documents to the exporter’s bank.

- The exporter’s bank pays the exporter the discounted contract value.

- On maturity the exporter’s bank presents the debt instrument to guarantor.

- Guarantor bank pays to the exporter’s bank

- Importer pays its own bank.

To help further illustrate how forfaiting works, here’s an example of what a transaction looks like with and without forfaiting.

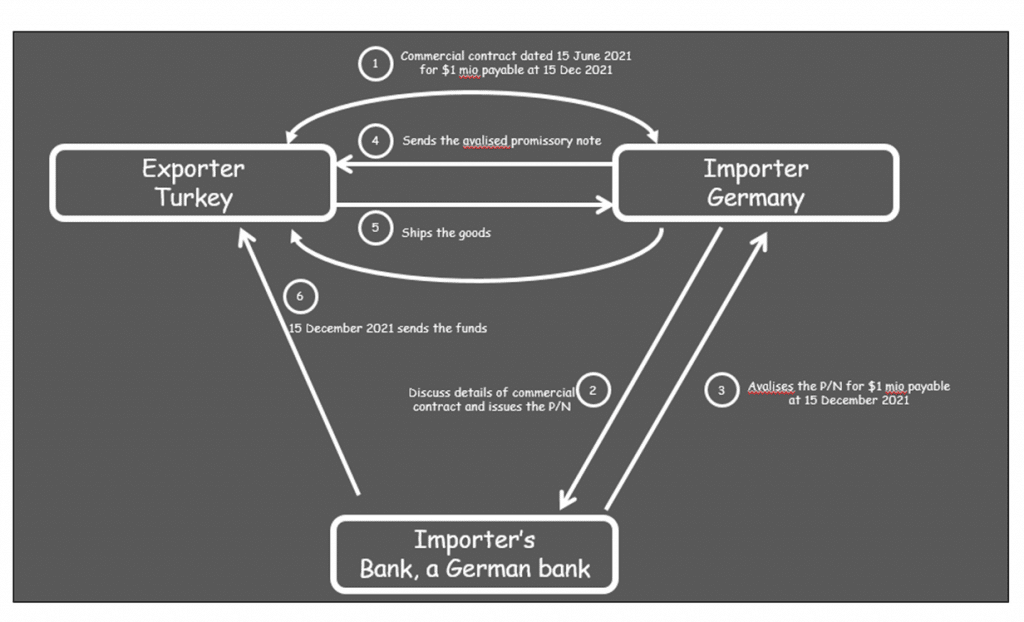

A sample transaction without forfaiting

Here is what a typical foreign trade transaction under a bank avalised promissory note looks like. The buyer and the seller of goods are in different countries.

Step 1: The German car company (importer) and the Turkish car spare parts company (exporter) agree on the details of the goods, shipment and payment terms and also decide not to use a confirmed letter of credit. But since the importer still prefers to pay later, the exporter does not want to bear the payment risk of the importer and asks for any form of bank guarantee.

Step 2: Importer approaches the German bank and provides details of its contact with the Turkish company and issues the promissory note (P/N)

Step 3: The German bank avalises the P/N

Step 4: Importer sends the original P/ N to the exporter

Step 5: Exporter ships the goods according their agreement

Step 6: As per their agreement, avalising bank pays the net amount stated on the P/N to the exporter on the agreed date (15 December 2021)

In this type of transaction, for the 6 month period the exporter carries the risk of;

- The avalising bank; risk of the German bank

- The exporter’s country; risk of Germany

- The currency fluctuation

- The interest rate

- Financing costs for further production in that 6 months

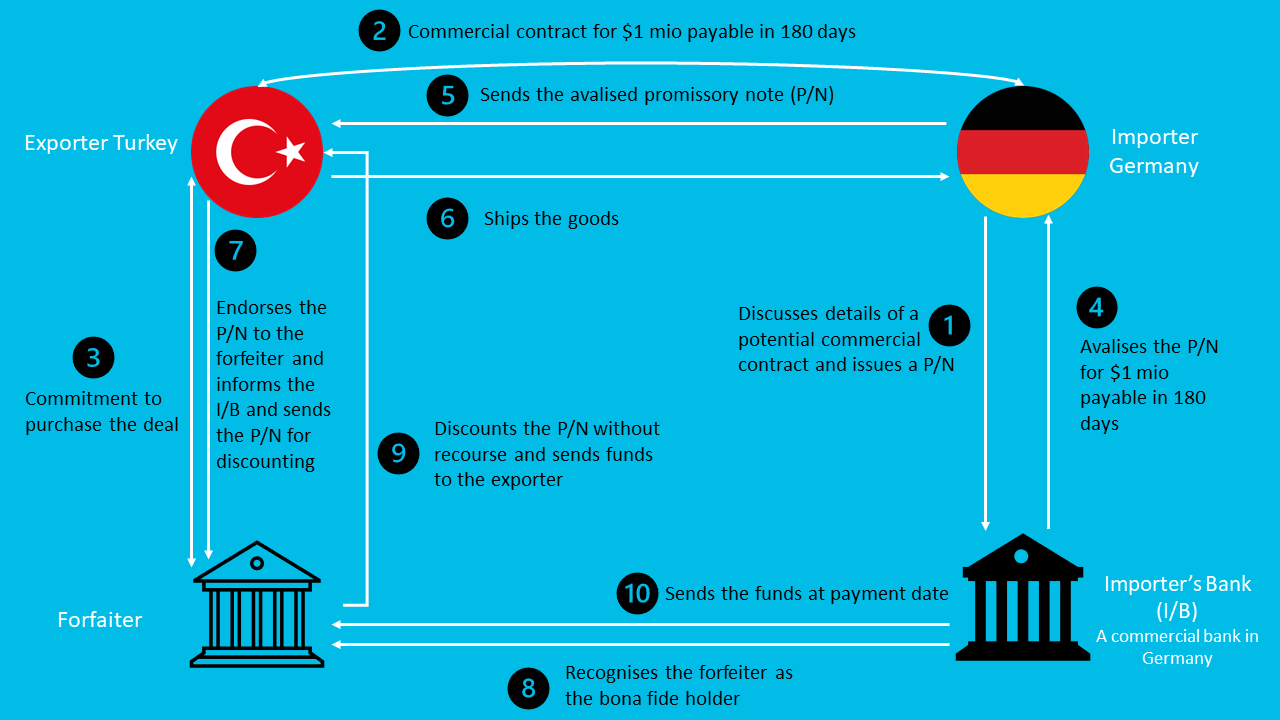

A sample transaction with forfaiting

This is what a typical forfaiting transaction looks like. The buyer and the seller of goods are located in different countries and during the course of negotiations between the exporter and importer for the supply of goods, the importer asks for credit terms.

Step 1: Exporter approaches the forfaiter (can also be a 3rd commercial bank) and asks for an indication of whether they accept the risk of a German bank for 6 months and how much it is likely to cost. At this stage the forfaiter needs to know:

- Country of the importer

- The underlying transaction (i.e. importer’s name, type of goods, value of the goods, expected shipment date)

- Re-payment terms sought by the importer

- What the format of the bank guarantee (L/C, P/N, B/E etc) will be

Step 2: The forfaiter provides the exporter with an indication of the costs involved.

Step 3: Exporter can ask the forfaiter to have a commitment to discount the P/N. The forfaiter issues a commitment which is accepted by the exporter and which is binding on both parties. This commitment will contain the following points:

- Details of the underlying commercial transaction

- Nature of the debt instruments to be purchased by the forfaiter

- Discount (interest) rate to be applied, together with any other charges

- Documents that the forfaiter will require in order to be satisfied that the debt being purchased is valid and enforceable

- Latest date that the exporter can deliver these documents to the forfaiter

Step 4: In return importer obtains the guarantee (can be a bill of exchange, promissory note etc) from his bank, A German bank avalises the P/N, andprovides the documents that the exporter requires in order to complete the forfaiting

Step 5: Importer sends the avalised P/N to the exporter

Step 6: Exporter ships the goods according to their contract

Step 7: Exporter endorses the P/N to the forfaiter and informs the importer's bank on the endorsement

Step 8: A German bank recognizes the forfaiter as the new bona fide holder and confirms that on the payment date the payment will be effected directly to the forfaiter instead of the exporter

Step 9: The forfaiter discounts the P/N and sends the net amount to the account of the exporter

Step 10: At agreed payment date a German bank pays the net amount to the forfeiter

In this example transaction, there are some clear advantages of forfaiting for the exporter:

- Since the transactions are without recourse it eliminates political, transfer and commercial risk of the importer,

- Protects the exporter from future interest rate increases or exchange rate fluctuations

- Gives the ability to the exporter to provide longer payment terms and yet receive the proceeds cash.

- Enables the exporter to do business in countries where the country risk would otherwise be too high.

- The balance sheet of the exporter does not carry accounts receivable, bank loans or contingent liabilities.

- No administrative and legal expenses that normally accompany other financing arrangements

- Importer receives additional credit through forfaiting from the supplier/exporter

Forfaiting vs factoring - what's the difference?

“Without recourse” or “non-recourse” means that the forfaiter assumes and accepts the risk of non-payment. Similar to factoring, forfaiting virtually eliminates the risk of non-payment, once the goods have been delivered to the foreign buyer in accordance with the terms of sale.

However, unlike factors, forfaiters typically work with exporters who sell capital goods and commodities or who engage in large projects and therefore need to offer extended credit periods from 180 days to seven years or more.

In forfaiting, unlike factoring, the receivables are normally guaranteed by the importer’s bank, which allows the exporter to take the transaction off the balance sheet to enhance key financial ratios.

About the author: Zeyno D. Davutoglu

Zeyno D. Davutoglu is the Executive Vice President / Division Director Bank Relations and Supply Chain Finance at Credit Europe Bank N.V.

Zeyno obtained her BA degree in International Relations, followed by an MA degree in European Studies.

She started her career in 1991 at Koc-American Bank Istanbul where she worked at the Financial Institutions Department until 1999. In 1999 she was appointed at Koratrade Ireland, an IFSC company in Dublin. Upon her return to Istanbul in 2001, she established the “Foreign Subsidiaries Co-ordination and Marketing” Division and worked as the head of division for another year, where she coordinated and assisted the marketing of the various foreign subsidiaries of the bank. In 2002 she started to work at Kocbank Nederland NV in Amsterdam.

In 2005 she joined Finansbank NV, and in 2006 she was asked to establish the Malta Branch of the bank, where she stayed for another 2 years. In 2008 she returned to the head office in Amsterdam as Division Director Bank Relations, currently responsible for financial institutions, EM loan trading and forfaiting and supply chain activities activities of the bank.

Zeyno was also a Chairperson at International Trade and Forfaiting Association Northern European Regional Committee until she got elected as board member in 2016. She served the Association as the Board Member with main responsibility on the educational activities of the Association until 2021.