This trade compliance guide was written for ICC Academy by Louise Wiggett and Helen Scrimgeour from Global Trade Solution (GTS). GTS provide consulting services to the international trade and supply chain community. The views expressed in this article do not necessarily represent the views of ICC or the ICC Academy.

What is trade compliance?

International trade compliance describes the processes and procedures by which goods are exported from one country and imported into another, operating within the laws, rules, regulations and requirements of each of the countries involved.

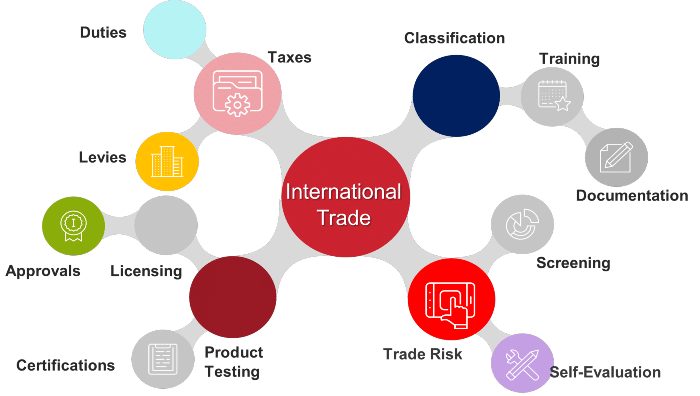

Trade compliance covers many aspects of international trade, each of which requires specific understanding and knowledge.

It is important to understand that regulations and other requirements can differ from country to country, and from one type of goods to another. Businesses must adhere to the specific standards and requirements economic, ethical, quality, supplier and consumer protection in each country.

Who needs to understand trade compliance?

All businesses, no matter their size, that are involved in the export and import of goods and services are responsible for adhering to the principles of trade compliance.

Business owners need to ensure that they understand the procedures and regulations that are applicable to their specific scenarios.

The burden of compliance is placed on the business owner. To this end, international trade processes should be continuously reviewed to ensure that non-compliance is avoided.

Large organisations may have entire teams dedicated to mitigating the risks. Their job involves continual assessment of trade compliance regulations and changes, ensuring that all sanctions and risk countries are mapped and proactively controlling the business’s exposure to risk.

Having a robust procedure to track trade compliance is important, as the repercussions of violating regulations can be serious and costly.

What are the consequences of non-compliance?

As the trade compliance landscape is becoming increasingly complex, so are the consequences of failing to comply.

Repercussions range from shipment delays for minor breaches to financial penalties and (in extreme cases) criminal sanctions for serious offences.

Non-compliance can lead to delays, financial losses and other penalties. Any such impact on the trade transaction may also negatively affect the trader’s customer relationships or reputation.

Ultimately, non-compliance will most certainly affect the trader’s profitability and potential to continue to do business and trade on a global basis.

What are the key elements of trade compliance?

Tariff classification

The correct classification of goods is fundamental for customs compliance as well as establishing correct duty rates, origin of goods, export control and many other customs procedures.

Classifying goods for trade is done using the Harmonized System (HS). The Harmonised System is a standard nomenclature for naming and classifying traded products, and is maintained and administered by the World Customs Organization.

It comprises more than 5,000 commodity groups; each identified by a six-digit code, arranged in a legal and logical structure and is supported by well-defined rules to achieve uniform classification.

The system is used by more than 200 countries and economies as a basis for their customs tariffs and for the collection of international trade statistics.

Over 98% of the merchandise in international trade is classified in terms of the HS.

Why is tariff classification important?

- Correct tariff classification is the legal responsibility of importers and exporters.

- Through correct tariff classification, the appropriate rates of duty, taxes and rebate provisions can be determined.

- Permits, licences and other documentary requirements can be determined by the tariff classification.

- Trade documentation and transmission of data can be standardised.

- Tariff classification of goods is an important tool in the collection, comparison and analysis of trade statistics for business planning and trade negotiations.

- Non-compliance can result in shipment delays, increased inspections, fines and other administrative penalties, or even seizure of goods.

What are the impacts of incorrect tariff classification?

- Incorrect application of tariff classifications can result in a particular trader’s shipments being flagged and investigated by customs authorities.

- Incorrect tariff classifications can also lead to fines and penalties at ports of entry, as well as shipment delays.

- If a product has been classified incorrectly and actually requires permits or other documents, the shipment could be delayed while these are obtained, or may even not be permitted to enter the country.

- Incorrect tariff classification could result in over- or under-payment of customs duty.

- If the duty paid is insufficient, the trader will need to pay the deficiency (and possibly be penalised).

- If excess duty has been paid, it is unlikely that the customs authority will refund this excess to the trader.

Learn more

Rules of Origin

The country of origin of goods is one of the crucial components of international trade compliance and is used in conjunction with tariff classification and valuation.

The WCO defines rules of origin as "the specific provisions applied by a country to determine the origin of goods and using principles established by national legislation or international agreements." (Revised Kyoto Convention).

Preferential rules pertain to whether the goods qualify for free or reduced duty rates under bilateral, multilateral, or international trade agreements to which a country is party.

Non-preferential rules are outside the scope of such agreements but are of interest to customs administrations and international traders as they relate to important aspects of the treatment of imported goods.

Origin can be thought of as the “economic nationality” of goods in international trade. It is important to understand that this may not necessarily be the country of export, and is derived by following the applicable rules of origin as defined in the relevant trade agreements.

The importance of origin determination

- Determining the origin of a product will indicate if the goods qualify for preferential rates of duty (either duty free or reduced rate of duty) under a specific trade agreement.

- The country of origin will also determine whether anti-dumping or countervailing duties might be applicable to the product.

- Where trade restrictions and prohibitions are in place, the country of origin of the product may determine whether it is permitted to enter the country or not.

- Likewise, specific permit requirements may also be applicable depending on the country of origin.

- Determination of the country of origin will also determine if there are quantitative restrictions on goods originating in a country subject to a quota.

- The country of origin will also dictate labelling and marking requirements.

- Accuracy of trade statistics is also dependent on origin determination.

Learn more

Valuation of goods

Knowing the correct valuation of goods is essential for applying and calculating customs tariffs.

Customs valuation is a customs procedure used to determine the customs value of imported goods in order to calculate the correct levels of customs duty, import VAT and to derive trade statistics. This method is intended to provide a single, fair, uniform and neutral customs valuation system for imported goods.

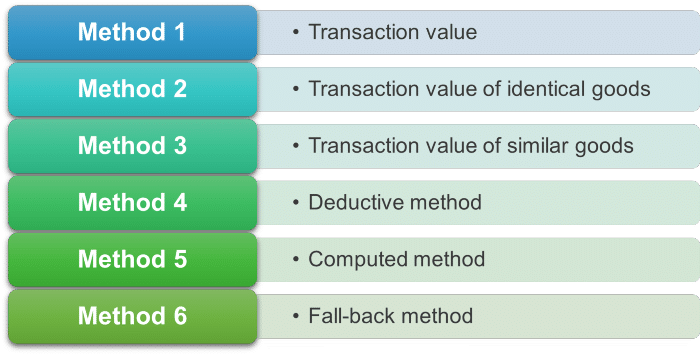

Customs administrations value imported goods according to the WTO Customs Assessment Agreement. The valuation must comply with one of the six valuation methodologies approved by the World Trade Organisation (WTO) and be declared on the Single Administrative Document.

At its simplest application, customs value is based on the transaction value of imported goods (i.e., the actual price of the goods). This constitutes the first and most important method of valuation referred to in the Agreement.

For cases in which there is no transaction value, or where the transaction value is not acceptable as the customs value because the price has been distorted as a result of certain conditions, the Agreement lays down five other methods of customs valuation, to be applied in the prescribed hierarchical order.

The six valuation methodologies

Why is valuation important?

The correct valuation of goods has a direct impact on the cost of importing goods. It is an essential component of the trade transaction, ensuring that the correct rate of duty is applied to the imported goods (in the case of ad valorem duties).

Specific duties

- Concrete sum charged for quantitative description of goods (eg USD 1 per item/unit)

- Customs value not required to be determined

- Valuation Agreement not applicable

Ad valorem duties

- Depends on the value of the goods

- Customs valuation is multiplied by ad valorem rate (eg 5%) to determine the amount of duty payable

Due to the potential complexity around determining customs value, it is often the subject of advance ruling requests.

It is important to understand that both overvaluation and undervaluation of goods could have an impact on trade.

Overvaluation can result in lost revenue to the company (since a higher rate of duty would be charged), while undervaluation may lead to delays in shipment and even penalties.

Learn more

Customs management

Customs management describes the practice that ensures that trade compliance regulations are met to ensure the smooth and speedy processing of goods upon entry into a customs administration.

Integrated customs management systems are designed to support import and export processes, expedite transactions and reduce the costs involved in international trade.

They improve compliance with the legal requirements that govern international trade, and facilitate greater co-operation in:

- Customs processing

- Transit and presentation

- Classification

- Electronic communication and document printing

More than 85 countries worldwide have implemented customs management systems to enable customs to discharge its fiscal and control responsibilities more effectively.

License management

Import licensing can be explained as the operational and administrative process by which documents are submitted for the application of the import of goods.

Import licences, requirements and conditions are country specific. When importing or exporting certain products it is the trader’s responsibility to check which licences or permits may be required.

There are controls, for example, on military/paramilitary goods, technology, medicines, chemicals, artworks, plants and animals.

Exporting or importing controlled goods without the right license is a criminal offence. Goods will be delayed at customs and may be confiscated.

Examples

Permits / licences

Certain controlled goods require permits or licenses before they can be exported from or imported into a country.

These are typically administered by government bodies, for instance a Department of Agriculture, Ministry of Health, etc.

Certificate of conformity / standards

Unsafe and unreliable imported products can result in injury, death or damage to property.

For this reason, most countries around the world have stringent requirements in place to ensure their consumers are protected from sub-standard products and goods.

Pre-shipment inspection

These are conducted by accredited bodies to ensure that products comply with the importing country’s requirements.

Health / veterinary inspections

Where the import of products poses a potential health risk (for instance live animals or animal products), additional inspections and certificates may be required.

Export controls

Like import controls, export controls define the procedures that must be adhered to in order to meet the legal obligations required for the export of goods.

Certain products and underlying technology are subject to export control legislation as they are considered dual-use items which potentially have harmful other uses. Alternatively, specific commodities such as lumber, firearms and even peanut butter could be controlled and subject to a special permit.

As part of product classification, it is the trader’s responsibility to classify all products against the appropriate legislation.

The trader must understand whether the product and the destination of that product are controlled, regulated or prohibited and whether a permit is required to proceed.

Different controls apply depending on the specific goods. Non-compliance with legislation can lead to substantial fines and even imprisonment.

Screening

Screening is an important part of trade compliance.

The screening process involves comparison of data relating to products, customers, suppliers etc. with data from a relevant external list to check if any products or companies are linked to trade embargoes or sanctions, or politically exposed and other risky entities. A trade embargo is a government order to restrict trade of certain goods or all goods entirely with a foreign country.

The screening process helps to ensure that the trader is not inadvertently conducting business with an undesirable person or party, which may place the trader at risk.

In order to mitigate risk, traders should conduct screening not only at the start of a new business relationship, but on a regular basis, and especially when handling transactions that include an outside party.

Sanction breaches are criminal offences and can lead to fines and even imprisonment.

Incoterms® rules

Incoterms® (International Commercial Terms) are an important set of rules published by the International Chamber of Commerce (ICC), which relate to international commercial law.

Incoterms® rules provide internationally accepted definitions and rules of interpretation for most common commercial terms used in contracts for the sale of goods.

Understanding Incoterms® is a vital part of international trade. Incoterms clearly state which tasks, costs and risks are associated with the buyer and the seller.

Incoterms® should be clearly stated on relevant shipping documents.

Learn more

Key takeaways

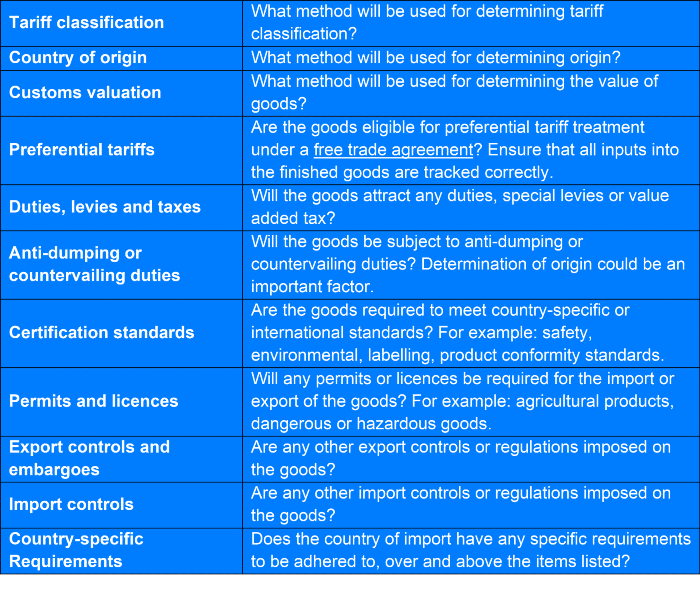

There are many regulatory requirements around trade compliance. When handling import compliance, there are several key aspects that need to be addressed:

- In international trade, goods must be classified according to the Harmonised System and in accordance with the importing country’s national tariff schedule.

- When importing goods, the country of origin needs to be stated as per the agreed Rules of Origin.

- The quantity of goods being imported needs to be declared.

- Companies need to report all fees, costs, and pricing changes.

Building blocks of a successful trade compliance programme

Trade compliance team

Business should ensure that they have a strong internal trade compliance team, responsible for understanding and adhering to trade laws and regulations. The size of the team will depend on the volume of trade transactions; however, it is important to understand that the team as a whole will need to have a specific skillset.

The trade compliance team will oversee the company’s trade activities, focusing on the following:

- Implementation of a compliance policy

- Ensuring the retention of records

- Product classification, valuation and origin

- Development of manuals and standard operating procedures (SOPs)

- Training of employees

- Keeping up to date with regulatory changes

- Monitoring of compliance adherence

Trade compliance manual

It is important that businesses document their policies and procedures in a trade compliance manual and ensure that trade regulations are adhered to.

The trade compliance manual should include:

- Customs policies

- Roles and responsibilities

- Import / export procedures

- Internal controls (eg screening)

- Record keeping

- Any company-specific requirements

Internal review

In addition to implementing policies and procedures through a trade compliance manual, it is also important that the effectiveness of these is tested and reviewed from time to time to ensure that there are no gaps and that the manual is maintained with any regulatory updates.

An internal review should cover:

- Frequency of testing (eg weekly, monthly, quarterly, etc)

- Sufficient sample size

- Reconciliation of financial records

- Checking of other documentary records

- Remedial actions (such as updating of the manual, training of staff, etc)

Checklist of considerations

You should consider the following when implementing a trade compliance programme:

The impact of COVID-19 on trade compliance

The world-wide response to the COVID-19 pandemic saw the implementation of a number of regulatory measures which affected global trade, with trade compliance particularly affected.

For example, countries implemented restrictions and controls around the import and export of goods to reduce the movement of cargo and people across borders, all in a measure to protect their populations from the spread of the virus.

Certain kinds of goods were also subject to new export and import controls. For example, medical supplies, face masks, hand sanitizer, etc. Over time, some of these were removed or minimised, while others remained in place.

Some examples of measures implemented in response to the pandemic:

- In an attempt to boost local business, Botswana implemented a ban on the import of face masks, encouraging local manufacturers to produce these locally.

- Exports in certain countries were controlled to ensure that a country did not run out of essential supplies.

- Namibia required that imported hand sanitizer comply with specific standards.

In addition to specific controls and measures on goods, countries also sought to enhance their digital solutions to minimise human contact.

This included making use of online platforms for management of client queries and implementing improved functionality in online customs management systems. Other measures included utilisation of non-intrusive inspection equipment.