This guest post is the latest in a series of interviews with the 20 course authors from our upcoming Certificate in Digital Trade Strategy (CDTS) which will be released in November.

This interview is with Stephan Wolf, CEO, Global Legal Entity Identifier Foundation (GLEIF). Stephan shares his expertise in Module 4 of the CDTS; Exchanging trade and supply chain data in a trusted environment and more specifically on the issue of corporate digital identity.

Why should an organisation make digitising their trade and supply chains a priority? What are the biggest potential benefits in your opinion?

Stephan Wolf (SW): Supply chain digitisation will lead to a broader inclusion of small businesses in international trade and open the industry to innovation. It will also reduce the costs of doing business and enhance efficiencies in cross-border transactions.

What do you think are the costs (either financially or operationally) of not digitising?

SW: Businesses that fail to digitise their supply chains risk falling behind competitors, missing out on new market opportunities and losing clients to competitors that offer more efficient and streamlined services.

What do you see as the biggest obstacles to trade and supply chain digitisation and what are some common pitfalls?

SW: Within global trade, counterparties might be referred to in dozens of different ways. These can include a registered legal name, ‘doing business as’ or commonly abbreviated name, any of the multiple usernames used to access banking systems, or even misspelled or truncated versions caused by manual entry errors. This makes accurately identifying information on them extremely complex, requiring a significant investment in time, money and resources.

Elegant in its simplicity, the legal entity identifier (LEI) reduces all of these identifiers into one unique, electronic, standard code that connects to annually verified business reference data and ownership structure information in a freely accessible online registry – the LEI Index. This can be quickly checked by anyone at any time, enabling companies and banks to know precisely who they are doing business with.

Taking advantage of the Global LEI Index will empower organizations across the board to cut costs, simplify and accelerate operations and gain deeper insight into the global marketplace.

If your counterparts – corporate customers, suppliers and other business partners – could all be uniquely, easily and speedily identified with the LEI, that would provide you with cost benefits and new business opportunities. It also supports sustainable and ethical sourcing.

Finally, and with regard to supply chain finance, we believe that the LEI could help optimize know-your-customer (KYC) processes, which in turn should make it easier to access finance.

What are your hopes for the new Certificate in Digital Trade Strategy (CDTS)? Why are you excited to be involved with this new online certification?

SW: Back in October 2021, the ICC released a study which estimated that a typical trade transaction involves up to 27 documents - altogether this can cost $80,000 per transaction and take up to three months to process. These inefficiencies limit market access for small business and create a barrier to entry for new market players.

Digitisation turns the industry upside down and creates opportunities to reduce costs and introduce new market participants. This is where the LEI as a global open standard for legal entity identification can play a role as one piece of the overall puzzle. We are excited to explore with industry experts how the LEI can be a part of this important sector innovation.

Can you tell us in more detail what a legal entity identifier (LEI) is and what problem or problems is it designed to solve?

SW: Each LEI contains information about the company – “who is who”, “who owns whom”. A uniform global LEI system will make it easier to identify legal entities and to verify their status. Global adoption of LEIs would help banks:

- Conduct know-your-customer due diligence

- Mitigate the risk of correspondent bank relationships being cut (i.e. de-risking – an action observed by banks in many regions today)

- Increase access to finance for small business in emerging markets by easing the flow of reliable information about small companies

- Promote the development of emergent technologies such as blockchain, thereby reducing costs

Legal entity identifiers, if more broadly adopted, could provide a useful common identifier and thereby an important starting point for corporate identity harmonisation.

Despite the clear benefits of LEIs, are there any potential problems or pitfalls that people should be aware of?

SW: There are a number of reasons for the limited adoption and implementation of the LEI. Notably, GLEIF’s current business model does not fully align the benefits and costs of LEI use for participants. The key issues include the following:

- The cost of obtaining an LEI, as well as the cost and burden of renewing it annually, are seen by many entities as too high, especially for smaller entities

- At the same time, the usability of data in the LEI system still falls short of authorities’ expectations (e.g. potentially out-of-date reference data due to missed annual renewals of the LEI, or incomplete information on parent entities based on the level of consolidation)

- Some supervisors and authorities have not fully recognised the relevance of the LEI to anti money laundering and combating the financing of terrorism (AML/CFT) screening in the context of, for example, the Financial Action Task Force (FATF) and the AML/CFT Expert Group (AMLEG) of the Basel Committee on Banking Supervision

- There is a lack of interest in, and awareness of, the LEI outside of the financial services sector, in part due to inadequate information and activities to promote the LEI (and its potential benefits) to authorities and entities active in those sectors.

- Legal requirements for the use of the LEI are lacking in many global jurisdictions. In many cases, even where use of the LEI is allowed, it is not required, which further reduces the incentive for entities to obtain one

- Finally, there is a lack of critical mass in the uptake of the LEI resulting from many of the above factors, which, given the network effects of such global identifiers, could create the risk of a vicious circle without an adequate external stimulus

The suboptimal acceptance rate of the LEI, mentioned above, together with insufficient reporting of parents, constitutes a factor that may hamper the reliability of financial stability analysis, making it difficult to accurately assess and compare risks across national markets. Existing gaps in the adoption of the LEI should therefore be addressed.

Can you describe what a vLEI is, why GLEIF created it and how it differs to a standard LEI and other digital certificates?

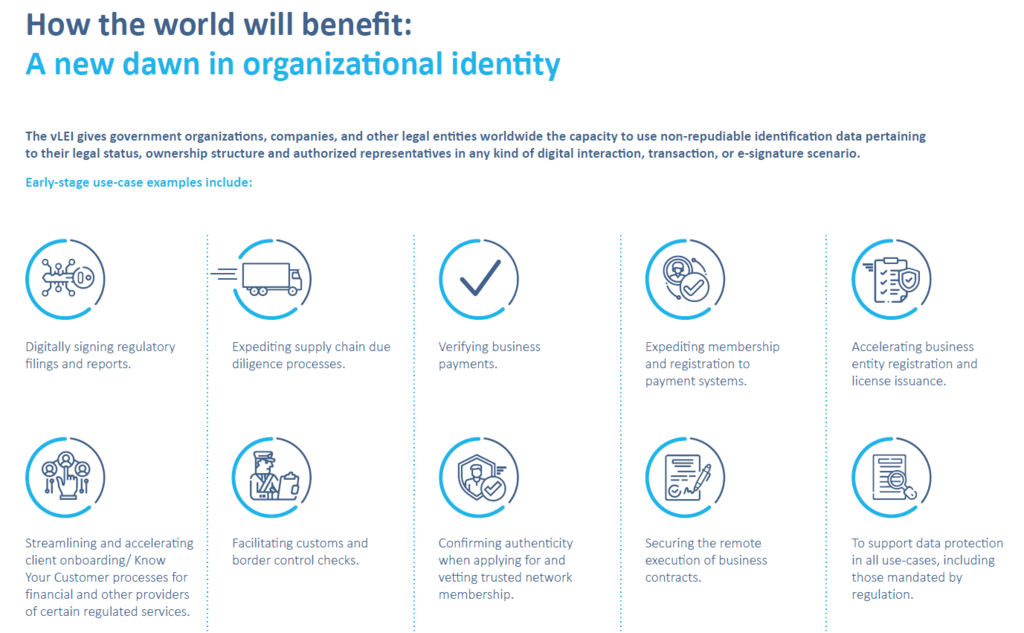

SW: GLEIF created the vLEI ecosystem with one clear goal: to create a standardised, digitised service capable of enabling instant, automated trust between legal entities and their authorised representatives, and the counterparty legal entities and representatives with which they interact.

GLEIF’s vision is that each legal entity worldwide should have only one global identity, which can support its participation in an increasingly digital economy.

The vLEI gives government organisations, companies, and other legal entities around the world, the capacity to use non-repudiable identification data pertaining to their legal status, ownership structure and authorised representatives in any kind of digital interaction, transaction, or e-signature scenario.

By embedding the LEI code in verifiable credentials, the vLEI offers a digitally trustworthy version of the LEI which allows automated entity verification, thus can replace the manual processes conventionally required to access and confirm an entity’s LEI data.