Introduction

It has been argued that a form of documentary credit (also known as a letter of credit) has been in existence for thousands of years and dated back to Babylonian times in Mesopotamia (present-day Iraq)[ref] Rufus Trimble (The Law Merchant and the Letter of Credit, 1947) [/ref], when Babylon was a key centre on the Silk Road, the ancient trade route between the Mediterranean Sea and China.

A documentary credit can be defined as a written undertaking given by a bank (issuing bank) to the seller (beneficiary) on the instruction of the buyer (applicant) to pay at sight or at a determinable future date up to a stated amount of money. Such undertakings are conditional upon the beneficiary’s compliance and are satisfied by a ‘complying presentation’ of documents. [ref] https://www.tradefinance.training/blog/articles/the-principle-of-autonomy/[/ref]

There exist many different types of documentary credit and it is important to understand not only the differences between each type, but also to appreciate the circumstances in which each could be used. This guide will cover eight of the most commonly encountered types of documentary credits. It also covers the difference between letters of credit and demand guarantees.

However, before we cover the types of documentary credit available, it is essential to be aware of the parties involved in documentary credit transactions (and the terms associated with them), a brief summary[ref] UCP 600 Article 2 Definitions [/ref] of which follows:

- Applicant: the party on whose request the credit is issued (the buyer or importer)

- Issuing Bank: the bank that issues a credit at the request of an applicant or on its own behalf.

- Advising Bank: the bank that advises the credit at the request of the issuing bank.

- Confirming Bank: the bank that adds its confirmation to a credit, in addition to that of the issuing bank, to honour or negotiate a complying presentation.

- Nominated Bank: the bank with which the credit is available or any bank in the case it is available with any bank.

- Beneficiary: the party in whose favour the credit is issued and normally the provider of the goods, services or performance (the seller or exporter).

Types of Documentary Credit

1. Irrevocable (and Revocable)

The opening introduction referred to a written undertaking given by an issuing bank. Such an undertaking is considered as irrevocable. In essence, this means that documentary credits can only be amended or cancelled with the agreement of the beneficiary and, if one is in place, the confirming bank.

- By default, a credit is irrevocable even if there is no indication to that effect.

- The concept of revocability does not exist in the ICC rules covering documentary credits – the UCP 600[ref]Uniform Customs and Practice for Documentary Credits 2007 Revision, UCP 600[/ref].

- If a revocable credit is to be issued, the terms of the revocability are to be incorporated into the credit.

Although the overwhelming majority of credits used in global trade are irrevocable, revocable credits do occasionally surface. However, extreme care should be taken with such instruments as they can be cancelled at any time without the consent of the beneficiary, and do not provide any satisfactory degree of security. It should be noted that banks would never confirm a revocable credit.

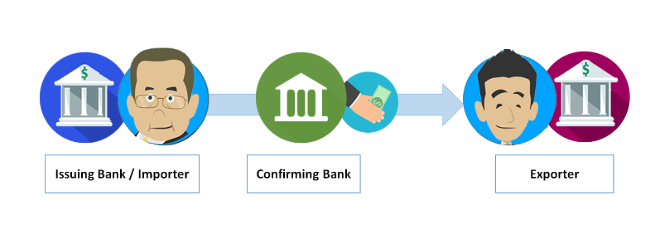

2. Confirmed

Confirmation is normally requested by a beneficiary (seller) at the time of agreeing the sale of goods, or agreeing to provide services or performance, and is usually a pre-condition inserted in the proforma invoice or sale contract.

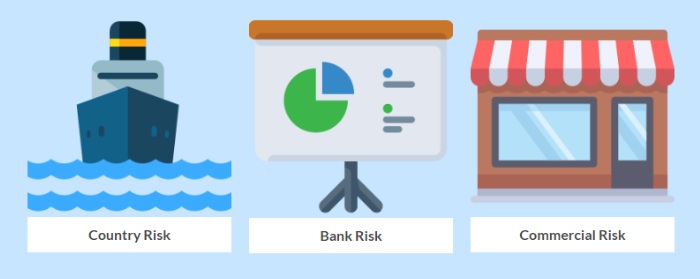

A beneficiary will usually request confirmation when it has concerns with:

- The risk of the issuing bank (e.g., the ability of the bank to honour its undertaking),

- Country risk (e.g., the payment risk of the country where the issuing bank is domiciled), and/or,

- Documentary risk (e.g., they require another bank to take the risk of non-payment due to the issuing bank determining that documents do not comply).

3. Silent Confirmation

This is a private arrangement between a bank and the beneficiary (seller) in which the advising bank adds a conditional guarantee of payment to the beneficiary without the knowledge of the issuing bank.

As a result of the higher risk involved, such an arrangement is more costly due to the fact that:

- It is not covered by UCP (although it is anticipated by UCP 600 sub-article 12 (a) wherein it is stated that an express agreement can be entered into between a nominated bank and a beneficiary).

- No confirmation request is in place from the issuing bank resulting in the usual responsibility of an issuing bank towards a confirming bank not being in existence.

This situation arises when an issuing bank sees no reason as to why a confirmation should be added to their credit, which they consider to be creditworthy enough.

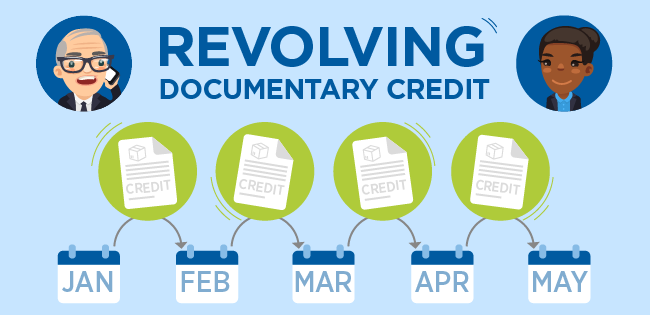

4. Revolving

In normal circumstances, an amendment is required in order to increase the value of a credit that has already been partially or fully utilised. However, a useful way around this is to utilise a revolving credit, which provides for the value of the credit to be restored.

Such credits may revolve in relation to time (e.g. monthly), in which case, it will be either:

- Cumulative, any sum not utilised during one month is carried forward, or,

- Non-cumulative, an explicit shipment each month.

Alternatively, it may revolve in relation to value, i.e. reinstated each time a shipment is made.

Revolving credits can be used to reduce the administrative workload for repetitive purchases of the same kind of goods from the same supplier at regular intervals.

For example, a credit issued on a revolving cumulative basis may allow for a monthly drawing of USD10,000 over a three-month period. If there is no drawing in month one, this is rolled over to the following month. The same if there is no drawing in month two, this is then rolled over to the final third month.

Further Learning: If documentary credits are a tool you need to use regularly in your job, consider taking one of our internationally recognised trade finance courses and qualifications to bring your knowledge and skills up to ICC-endorsed, global standards. You can choose to focus specifically on documentary credits over a single course at an introductory or advanced level or earn a broader trade finance qualification like our Global Trade Certificate (introductory) or Certified Trade Finance Professional (CTFP) (advanced) that both include courses on documentary credits as part of a wider curriculum that also covers other trade finance techniques.

5. Red & Green Clause

Such credits contain a special clause that allows the seller to draw on the credit prior to shipment of goods and presentation of documents. Historically, this clause was written in red or green ink.

- Unsecured or Clean Red Clause:

- Required documents do not include evidence of goods.

- Secured or Documentary Red Clause:

- Advances are made against presentation of warehouse receipts, or similar documents, together with seller’s undertaking to deliver the bill of lading and/or other required documents upon shipment.

- Green Clause:

- Allow for advance payment but provide for storage of the goods in the name of the bank as security.

6. Transferable

This type of credit allows the seller (‘first beneficiary’) to transfer the credit, fully or partially, to one or more third parties (‘second beneficiary’). In order for this practice to be effective, the credit must clearly state that it is transferable.

- Any transfers must be made on exactly the same terms and conditions of the credit, including confirmation, if any, with the exception of:

- the amount of the credit,

- any unit price stated therein,

- the expiry date,

- the period for presentation, or

- the latest shipment date or given period for shipment,

- any or all of which may be reduced or curtailed.[ref]UCP 600 Article 38[/ref]

It should be noted that a bank is under no obligation to transfer a credit except to the extent and in the manner expressly consented to by that bank. Unless otherwise agreed at the time of transfer, all charges incurred in respect of a transfer (such as commissions, fees, costs or expenses) must be paid by the first beneficiary.

Key Issues:

- A credit may be transferred in part to more than one second beneficiary provided partial drawings or shipments are allowed.

- A transferred credit cannot be transferred at the request of a second beneficiary to any subsequent beneficiary.

- The percentage for which insurance cover must be effected may be increased to provide the amount of cover stipulated in the credit.

- The name of the first beneficiary may be substituted for that of the applicant in the credit.

If the name of the applicant is specifically required by the credit to appear in any document other than the invoice, such requirement must be reflected in the transferred credit.

The ICC issued a policy paper in October 2002 on transferable credits.[ref]https://iccwbo.org/content/uploads/sites/3/2002/10/Transferable-credits-and-the-UCP-500.pdf[/ref] Whilst relating specifically to UCP 500, much is still applicable today and can be used as a reference point for examples. It should be read in conjunction with article 38 of UCP 600.

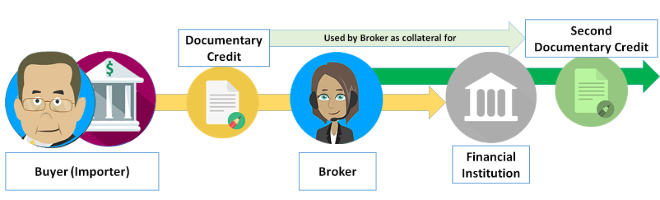

7. Back-to Back:

Such credits are commonly used by traders who act as ‘middlemen’ between the source supplier and the final buyer.

In this process, two separate Credits are issued:

- A Master Credit in favour of the ‘middleman’, and,

- A Back-to-Back Credit in favour of the source supplier.

The terms and conditions of the Back-to-Back Credit are likely to be similar to those of the Master Credit except for:

- The credit amount,

- The unit price,

- The expiry date,

- The latest shipment date, and,

- The presentation period.

The primary source of repayment for the issuer of the Back-to-Back credit is from the proceeds received from the Master Credit. Care should be taken when being involved in this type of transaction, as there may be differences of opinion between each bank as to interpretation of terms and conditions.

8. Standby Letter of Credit

Standby credits are very similar to demand guarantees (sometimes referred to as bank guarantees), the prime variation being in terminology and practice. Whilst used globally, they are more commonplace in the United States. Such a credit represents a secondary obligation covering default only, and provides security against non-performance as opposed to performance (as is the case with a normal documentary credit).

In other words, if an expected action does not take place as covered by the standby, then a claim can be made. With documentary credits, claims are made against actual actions, e.g. shipment of goods.

A standby is often used to cover, and to mitigate, the many risks that can occur in finalising a contract between a buyer and seller. As with a regular documentary credit, a key feature of a standby is independence from the underlying contract. Such autonomy provides the parties with separate security in the event of non-performance.

A wide variety of types exist but those more commonly seen in trade finance transactions are listed below:

- Performance – agreeing to undertake, deliver and/or complete contractual obligations.

- Advance Payment – undertakes repayment of all or part of a percentage of the value of a contract that has been paid by the beneficiary to the applicant as a down payment, advance payment, or deposit, upon the signing of the contract.

- Bid or tender bond – ensures a bidder cannot alter its tender proposal, or withdraw from the tender process, before the tender is awarded.

- Counter – a standby issued by one bank, in favour of another bank, to support the issuance of a standby, guarantee, documentary credit or other form of undertaking, by that other bank.

- Financial – supports a financial obligation to pay or repay.

- Insurance – reinforces applicant obligations in respect of insurance or re-insurance activity.

- Direct-pay – not necessarily related to a default and is likely to be the primary means of payment rather than secondary which is normally the case.

- Commercial – acts as a security for payment of goods or services not settled by a buyer under other arrangements i.e., via open account trading or documentary collection.

Standbys can be subject to a variety of ICC rules, such as UCP 600, URDG 758 or ISP98. Reference to a standby was first made in UCP 400. This continued to be the case in UCP 500, and still applies under UCP 600.

However, as mentioned above, it needs to be recognised that a standby letter of credit, as opposed to a documentary credit, covers a secondary obligation, i.e., default or non-performance rather than performance. Accordingly, ISP98 was introduced in 1998 due to the fact that many facets of UCP were inappropriate (if not incorrect) for the handling of standby letters of credit.

ISP98 is often seen as being more legalistic in its language than UCP 600. The prime reason for this approach is explained in the introduction to ISP98, which states, in essence, that standbys are often intended to be used in disputes and the rules are, therefore, written to provide guidance to judges and lawyers.

You can learn more about standby letters of credit with ICC Academy’s dedicated online course.

Documentary Credits vs. Demand Guarantees

Similarities:

- Both relate to a bank’s obligation to pay against presentation of compliant documents or demands as stipulated within the instrument, and/or as required by ICC rules as applicable.

- Both instruments are autonomous in that the bank has no interest in the underlying sale or other contract.

Differences:

- Demand Guarantees (sometimes referred to as bank guarantees), as with Standby Credits, represent a secondary obligation covering default only, thus providing security against non-performance as opposed to performance (as is the case with a typical Documentary Credit).

- In order to obtain payment under a Demand Guarantee (again as with Standby Credits), a presentation does not generally include transport documents, and often consists solely of a simple written demand.

- The most applicable set of ICC rules for Documentary Credits is UCP 600 whereas, for Demand Guarantees, it is URDG 758.

You can explore guarantees in more depth in ICC Academy’s introductory and advanced courses on the topic.

Summary

In summary, documentary credits (also known as letters of credit) are:

- Are arrangements by banks for settling international commercial transactions.

- Provide a form of security for the parties involved.

- Ensure payment provided that the terms and conditions of the credit have been fulfilled.

- Mean that payment by such method is based on documents only, and not on merchandise or services involved or underlying commercial contracts.

There are three important points to remember:

- Credits are separate from the contract on which they may be based.

- In documentary credit operations all parties deal only in documents.

- A documentary credit is a means to facilitate the settlement of international trade transactions.

In addition, it should be noted that a documentary credit is not:

- A contract between a buyer and a seller.

- A guarantee that the seller will definitely receive payment.

- A guarantee that the buyer will receive the goods he ordered.

Further Learning: If documentary credits are a tool you need to use regularly in your job, consider taking one of our trade finance qualifications to bring your knowledge and skills up to ICC-endorsed, global standards. You can choose from either the Global Trade Certificate (GTC), for trade finance professionals with less than 5 years’ experience, or our Certified Trade Finance Professional (CTFP) programme for more experienced practitioners. Both of these professional qualifications will give you an in-depth understanding of documentary credits along with other commonly used trade finance techniques, including guarantees and collections, as well as supply chain finance.

Key Terminology

Lettter of Credit vs Documentary Credit

Both terms are in common usage and are synonymous. There is no distinction between the two but, as ICC rules commonly refer to ‘documentary credits’[ref]In particular UCP 600 and ISBP 745[/ref] , this is the term used within this module.

Sight / Usance

As highlighted in UCP 600 , credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.

Honour is defined as meaning:

- To pay at sight if the credit is available by sight payment.

- To incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment.

- To accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance.

Amendments

A credit can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank, if any, and the beneficiary.[ref]UCP 600 Article 10[/ref]

Autonomy

A documentary credit has its own terms and conditions which do not rely upon the terms or performance of the sales contract. This is the principle of autonomy and relates to a documentary credit being treated as an independent transaction. The autonomy of a documentary credit has been re-confirmed in law many times over the years.

In effect, this leads to a documentary credit being considered as a primary means of payment (as opposed to a demand guarantee or standby letter of credit which is a secondary means of payment).

Complying Presentation

Complying presentation means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of UCP 600 and international standard banking practice. This is further expanded in UCP 600 Article 15.

Instalments

UCP 600 article 32 states that when an instalment is not drawn or shipped within the allowable period, then the credit ceases to be available for that and any subsequent instalment.

Letter of Credit vs. Documentary Credit

Both terms are in common usage and are synonymous. There is no distinction between the two but, as ICC rules commonly refer to ‘documentary credits’ , this is the term used within this module.

UCP 600

First published in 1933, and revised on five occasions since, the latest version is known as UCP 600. This comprises 39 Articles, which establish the requirements necessary to regulate documentary credit operations.

URDG 758

URDG 758 were adopted by the ICC Executive Board on 3 December 2009, and came into force on July 1, 2010. The new rules apply to any demand guarantee or counter-guarantee where incorporated by reference in the text. They can also apply as trade usage or by implication from a consistent course of dealing between the parties to the demand guarantee or counter-guarantee where so provided by the applicable law. The new rules do not merely update URDG 458; they are the result of an ambitious process that seeks to bring a new set of rules for demand guarantees into the 21st century, rules that are clearer, more precise and more comprehensive.[ref]Introduction to URDG 758, Georges Affaki[/ref]

ICC Uniform Rules for Demand Guarantees URDG 758 are increasingly being incorporated into international trade contracts, where they provide a welcome element of financial security and trust in a precarious economic climate.[ref]https://iccwbo.org/media-wall/news-speeches/icc-demand-guarantee-rules-urdg-758-celebrate-two-years-of-rising-popularity/[/ref]

Practical notice:

- This guide is intended to be a practical complement to other training solutions and to provide guidance. You can find all ICC Academy’s online trade finance courses here.

- There are many important regulatory restrictions and requirements as well as business considerations that this guide does not cover.

- Nothing contained herein is to be considered as the rendering of any legal or other professional advice for specific cases and readers are responsible for obtaining such advice from their own legal counsel or other professionals.

About the author:

David Meynell

Senior Technical Advisor, ICC Banking Commission

Co-owner www.tradefinance.training

Managing Director TradeLC Advisory

Tel: +44(0)7801 922359

Email: davidmeynell@aol.com

Further Learning

If you would like to enhance your understanding of documentary credits and trade finance further, we recommend taking our one of our internationally recognised, online trade finance certificate programmes.

Global Trade Certificate (GTC):

The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and settlement methods available.

GTC Students get access to 14 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which you can use to improve your career prospects and work towards more advanced qualifications such as the CTFP.

Certified Trade Finance Professional (CTFP):

The CTFP is our advanced trade finance programme intended for those with five or more years’ experience working in trade finance or those with an existing trade finance qualification from the ICC Academy or LIBF. It is designed to give you the tools to confidently sell, deliver and process global trade finance solutions and is fast becoming an industry standard for senior trade finance positions.

CTFP Students get access to 11 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance, supply chain finance, fintechs, trade operations and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which will qualify you for more senior trade finance positions and help to fast-track your career.